This past week, one of the biggest stories in recent cigar industry history took place as Swisher International announced they had entered into an agreement to acquire Drew Estate Tobacco Company. Last month, shockwaves rode through the cigar industry as General Cigar Company acquired the brands of Torano Family Cigars and Leccia Tobacco. As big as the shockwaves that were sent with those acquisitions, they pale in comparison to this past Monday’s announcement. Drew Estate was one of the largest privately held handmade cigar companies in the world, and Swisher is the largest cigar producer in the world. One thing that is certain is that the acquisition will be a create a lot of possibilities and opportunities for the two companies – as well as more questions to be answered.

Drew Estate Tobacco Company is Being Acquired Lock, Stock, and Barrel

The Torano and Leccia Tobacco acquisitions were brand acquisition by General Cigar. When the transaction is completed, this will be a total takeover of Drew Estate by Swisher International. It included not just the brands, but the entire tobacco inventory, Drew Estate’s La Gran Fabrica, and all of the company’s resources including its people. The Torano Family Cigars and Leccia Tobacco companies essentially “shut down” when the brands were acquired. In fact Torano’s staff didn’t go to General at all – and with Leccia Tobacco, founder Sam Leccia was the only one who went over.

This takeover is going to introduce a completely different set of dynamics. Unlike the Torano and Leccia, there is an organization left standing and no doubt with a parent company in the mix, it will have an impact from top to bottom.

Drew Estate Tobacco Company Becomes a Subsidiary of Swisher International

When the announcement of the acquisition was made, up front it was said that Drew Estate Tobacco Company would become a subsidiary of Swisher International. As a result, Swisher has said it would preserve the existing Drew Estate management structure as well as many jobs.

In the press release, Drew Estate President Michael Cellucci said, “After the transaction closes, we will continue to run our business as we have in the past, and will be able to leverage the resources of Swisher to continue our growth with a renewed focus on our commitment to quality products and people – two of the core principles of the Drew Estate belief system.”

My feeling is that the first year will continue business as usual, but it will be the second year where there is more assimilation. As these months go by, Swisher International will most likely implement operational procedures and practices, and this will ultimately have an impact on the day to day operations of Drew Estate. The extent of what this will be is an unknown.

Drew Estate has established a very unique culture in its company. My guess for Swisher to make a major acquisition like Drew Estate, they saw something special to bring into their existing company. While I wouldn’t expect Drew Estate culture to overtake Swisher’s culture, I can see some influence back into the parent company.

In the meantime Drew Estate co-founders Jonathan Drew and Marvin Samel are staying on – along with company President Michael Cellucci and newly named Master Blender Willy Herrera. There has been no word if these are contractual to facilitate the transition or longer term moves. It is pretty much a given Herrera will continue in his current role, but no specifics were disclosed on what Drew, Samel, and Cellucci’s roles will be going forward.

To sum up my thoughts, I go to what Drew Estate CEO and President Steve Saka said, “things always change”.

Production and La Gran Fabrica

Last year Swisher International announced it was returning to the premium handmade cigar business. The approach taken is that Royal Gold Cigars partnered with leading factories in countries like the Dominican Republic, Honduras, and Nicaragua to produce their blends.

As we discussed in our background on Swisher International, the company has been involved in premium hand-made cigars before. In fact, in the late 1990s, the company partnered with various factories. This time upon returning, the approach taken was very different. They were taking what some could argue is an approach taken by some “boutique” cigar companies – namely contracting out with existing factories (one of them being Drew Estate) to make their cigars.

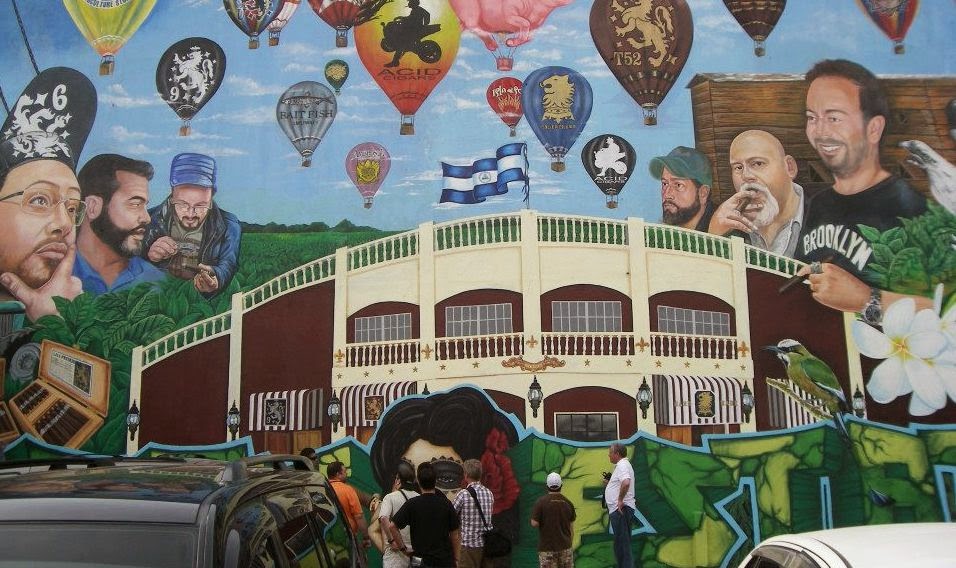

The acquisition now gives Swisher International the massive Drew Estate La Gran Fabrica factory (including the DE2 Leaf Processing Facility). This facility at over 114,000 square feet and produces 95,000 cigars per day is the largest in Nicaragua. Having the Drew Estate factory as an asset is an absolutely hugh plus in terms of making a statement in handmade premium cigars. It is an attractive option, but not one that is not a silver bullet. The demand for premium brands such as Liga Privada been high and its well documented that there is a finite amount of tobacco to produce this limited brands. In fact, the My Uzi Weighs a Ton brand is made at Joya de Nicaragua. Drew Estate has plenty of tobacco, and Swisher will continue to have a vast arsenal of tobacco. However the limited tobaccos that make brands such as Liga Privada are still limited and Swisher isn’t going to be able to wave a magic wand to fix it without something giving way.

While there have been the departures of Saka and Nicholas Melillo, there still is a lot of talent in these factories that make some very good products. If its profitable, I wouldn’t expect Swisher to rock the boat here. If its not, there could be changes.

There are other questions here. Will Swisher continue to make the Java line for Rocky Patel Premium Cigars Will the Royal Gold Cigars brand continue to leverage other factories for future brands?

Distribution: Sales and Marketing

By bringing in Drew Estate, the distribution advantages to Swisher are huge. They won’t have to figure out how to build a sales force, because they now have a ready made one with the Drew Estate team. This also could be to their advantage with Royal Gold Cigars – their current premium cigar subsidiary.

As we mentioned, the approach that Royal Gold Cigars was taking was similar to what some boutique cigar companies are doing. The difference is that with Royal Gold Cigars, Swisher wasn’t getting back into the premium handmade business to be small batch model. They were looking to make a big bang upon this return. While there has definitely been quality blends, these cigars were not finding footprints in many traditional brick and mortar premium cigar shops.

While Royal Gold Cigars does have a sales and marketing force, the acquisition of Drew Estate now gives the Swisher’s premium cigar division a strong field sales force and a team known for innovative marketing. My feeling is that Swisher is not going to squash that model, but on the contrary – they will use it to their advantage. Royal Gold Cigars’ President Alex Goldman told Cigar Coop that he expects the Drew Estate Sales and Marketing Teams to start to assume responsibility for the Royal Gold Cigars Premium brands in early 2015. This validated my feeling that it would make no sense to have Swisher’s sales force, which is focused more on the convenience store end of things to try to sell Drew Estate products.

The Distribution Agreements

Drew Estate has had a long standing distribution agreement with Joya de Nicaragua in the United States. In the past year, they added Royal Agio Cigars – expanding their footprint in the small cigar and cigarillo space, and Tsuge Pipes – expanding their footprint in the pipe world. Swisher International CEO and President Peter Ghiloni acknowledged the value of these partnerships in the press release announcing the acquisition. Royal Agio and Tsuge have expanded the Drew Estate portfolio to be more diverse. In addition to providing excellent handmade products, Joya de Nicaragua has been a great partner to Drew Estate – including providing production for some of the products.

The small cigar and cigarillo products of Royal Agio most interest me. Could there now be more routes to market (i.e. convenience stores) under the bigger Swisher umbrella with these products?

Anything in terms of what the long term prognosis of these distribution agreements would be purely speculative but the immediate acknowledgment by Swisher seems to indicate these will remain part of the Drew Estate value proposition.

The Competition

This can be subject to some debate, but in the machine made space, one of the competitors with Swisher International is Villiger. Villiger’s power has been primarily in machine-made cigarillo / small cigar products. In the past few years, Villiger has put some attention on its presence in the handmade cigar industry. The establishment of Villiger North America was done to focus on the U.S. market in that realm.

For handmade cigars, the approach that Villiger has taken has been similar to what Royal Gold Cigars has been doing – namely partnering with established factories to make their products. Swisher now raises the stakes on a competitor. They acquire one of the larger premium cigar companies, are able to leverage their sales force, and now they have a huge factory.

While Drew Estate doesn’t play directly in the small cigar / cigarillo space, the distribution agreement with Royal Agio Cigars now gives Swisher another arm in that area as well.

The Question of Acid

Much of the success of Drew Estate can be attributed to the Acid brand. This is Drew Estate’s infused premium cigar line. The Acid brand has become enormously successful and became a game-changer for this category of cigars. With looming regulations in the United States by the Food and Drug Administration, the Acid brand is suddenly in the crosshairs. While infused / flavored cigars weren’t officially spelling out with the recent Deeming Document of proposed regulations, there is a real fear that infused / flavored cigars would be next. Under current proposed regulations, some of the Acid line (post 2007) also faces the possibility of having blends submitted to the FDA for approval.

No doubt Drew Estate has been concerned about the future of their company with these regulations coming. Co-founder Marvin Samel actually re-located to the Washington DC area and invested both time and resources in the legislative fight. While we don’t know how the implemented regulations will flush out, it is clear that there is considerable risk for Drew Estate.

In the end there weren’t a lot of companies who had the resources to take such as risk and take Acid on. Swisher International, with their resources is probably among the few who could roll the dice, take the risk, and absorb any consequences. Swisher International isn’t going into this deal with blinders are and they have the resources to keep up a fight.

In the meantime, Swisher will now solidify its hold on the infused / flavor space with a two-headed monster in Acid and Swisher Sweets. When Drew Estate launched its G-Fresh packs, it was clearly aimed at the convenience store space. No doubt Swisher will use their paths to market in this space to put more Acid cigars in the convenience store space.

Growing Drew Estate

|

It ha been widely said that Drew Estate was carrying some debt prior to the acquisition. This was acknowledged in the October 21 edition of Cigar Insider. Back when the DE2 facility opened Cellucci had commented, “the cost was significant for a privately held company”. The cost was said to be over $4,000,000.00. While we don’t have any exact numbers, I think its safe to say these costs had some impacts.

I have no empirical data on the financial status of Drew Estate, nor will I attempt to guess it. I also cannot say the impact the debt had on the sale of the company. I will say, it’s hard for me to believe that this played no role. CEP Ghiloni told Cigar Insider that once the transaction was free that Drew Estate would be debt free.

More importantly, the debt had to be an inhibitor in terms of taking Drew Estate to the next level. With Swisher coming in an alleviating that burden, it does put Drew Estate in a better position to now focus on growth. Swisher certainly has the resources to help ensure that this happens – and Drew Estate has the people, facilities, and of course the tobacco.

I ha very been a Natural Dirt smoker for years. I’m disappointed (pissed) that it’s discontinued. What can I replace it with.