Scandinavian Tobacco Group (STG) has announced its earnings for the third quarter of 2023. The big news is the company is reporting negative sales growth of 3.9% YoY. At the same time, STG reported an EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) margin of 26.5%. The EBITDA margin is a measure of a company’s operating profit as a percentage of its revenue.

The company says the numbers are still in line with the revised guidance it issued earlier this year.

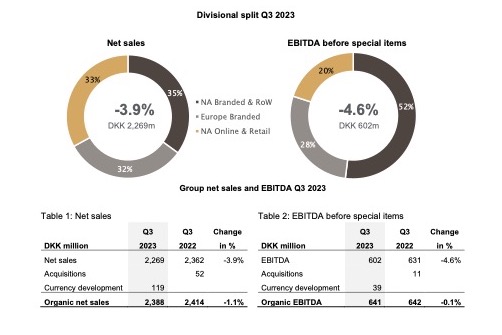

STG has highlighted the following financials for Q3:

- Net sales decreased by 3.9% to DKK 2.3 billion (DKK 2.4 billion).

- Organic net sales growth was -1.1%.

- The EBITDA margin was 26.5% (26.7%).

- Free cash flow before acquisitions was DKK 622 million (DKK 462 million).

- Adjusted Earnings Per Share (EPS) were DKK 4.1 (DKK 4.4).

- Return on Invested Capital (ROIC) was 12.9% (13.2%).

- Growth Enablers account for close to 8% of the Group’s net sales.

- In the first nine months of 2023, net sales decreased by 1.8% to DKK 6.5 billion (DKK 6.6 billion), organic net sales growth was -1.2%, the EBITDA margin was 24.6% (25.9%), free cash flow before acquisitions was positive by DKK 602 million (DKK 735 million) and Adjusted EPS were DKK 10.8 (DKK 11.6).

Meanwhile, STG’s guidance for the year has remained unchanged:

- Net sales in the range of DKK 8.7-9.0 billion

- EBITDA margin before special items in the range of 23.5-24.5%

- Free cash flow before acquisitions in the range DKK 1.1-1.3 billion

- Adjusted EPS in the range of DKK 14.0-16.0

STG says that Consumer trends for the cigar categories remained unchanged throughout the third quarter. Decreasing volumes are being partly offset by pricing and increasing sales from Growth Enablers (retail stores, Next Generation Products “NGP” and international sales of handmade cigars). The expectations for the full year are based on a recovery in net sales growth for the fourth quarter of the year primarily as a result of the positive trend in North America Online & Retail and growth in Europe Branded and comparison to a soft fourth quarter last year. The main uncertainties to the full year expectations remain the volume development in Europe Branded and inventory adjustments with customers in the US.

“With the performance in the third quarter, we are on track to deliver on our revised guidance from August with both cash flow and margin recovering in the quarter. Although key uncertainties persist, we continue to make good progress in the online business and the Growth Enablers are also performing well. Whereas the market share for Europe Branded continued to decline, we remain confident that the more aggressive initiatives launched over the past few months will support a stabilization,” commented Niels Frederiksen, CEO of STG, in a press release.

Scandinavian Tobacco Group is the parent company of General Cigar Company, Forged Cigar Company, Cigars International, and Meier & Dutch.

A full copy of the earnings can be found here.