On September 14, 2017, the U.S. House of Representatives passed a twelve-bill spending package for the 2018 Fiscal year that included the Agriculture Appropriations Bill that was crafted by a House Subcommittee earlier this summer. This bill includes language that calls for a premium cigar exemption and predicate date change to August 8, 2016. It marks the first time a bill which includes such language for an exemption or predicate date has passed on a legislative vote. While certainly not a “win” for the premium cigar industry, it’s still an important milestone – and as we will see there is a long road still ahead.

Background

Each year, various Appropriations subcommittees put together a budget to fund the government. This includes programs under the U.S. Food and Drug Administration. Specifically for funding the FDA Deeming Rule affecting premium cigars, the funding comes through the Agriculture Subcommittee in the House of Representatives. For the past two years, language has been put in place that calls for an exemption for premium cigars. This language means that funding dollars will not be allocated for the regulation of premium cigars.

Similar language was also put in to extend the predicate date from February 15, 2007 to August 8, 2016. By extending the predicate date, it reduces the amount of product subject to regulation, thus affecting the funding required.

Each of the past two years, this language has made it to the Agriculture Appropriations Bill. Last year a Continuing Resolution was implemented that overrode this language and allowed the government to operate by extending the funding for the previous fiscal year. As a result, the Appropriations Bill never made it to the House floor to a vote.

This year, the Appropriations Bill did make it to the House Floor and it passed by a vote of 211-198. If this is passed into law, the exemption and predicate date change covers the Fiscal Year from October 1st, 2017 to September 30th, 2018. Funding for the government runs out on December 8, 2018.

What Happens Next

In order for the Appropriations Bill to become law, it must pass in both the House of Representatives and the Senate before going to the President for his signature. The challenge is that while the language for the exemption and predicate date were on the Fiscal Year 2018 House bill, the corresponding Senate bill does not have that language in it.

Assuming the Senate Bill also passes, the differences in the content between the two bills must be resolved. This goes through what is known as a “conference committee” process where select members of Congress will agree to compromises and this will eventually lead to a common piece of legislation.

It might seem redundant to have both a premium cigar exemption and predicate date change on the bill, but this could very well play into the conference committee process. A scenario is quite possible where the Senate agrees to add the predicate date change, but not the premium cigar exemption. In the end, having both items on the bill gives the cigar industry a little extra insurance during the process.

This is not going to be an easy process. Glynn Loope, Executive Director of Cigar Rights of America has always been cautious when it comes to whether language like this can make it through the Senate. In addition, there is an influential group of anti-tobacco members of the Senate who have long favored regulation. It is also expected that anti-tobacco groups will also be actively lobbying to prevent this language from making it into the final law.

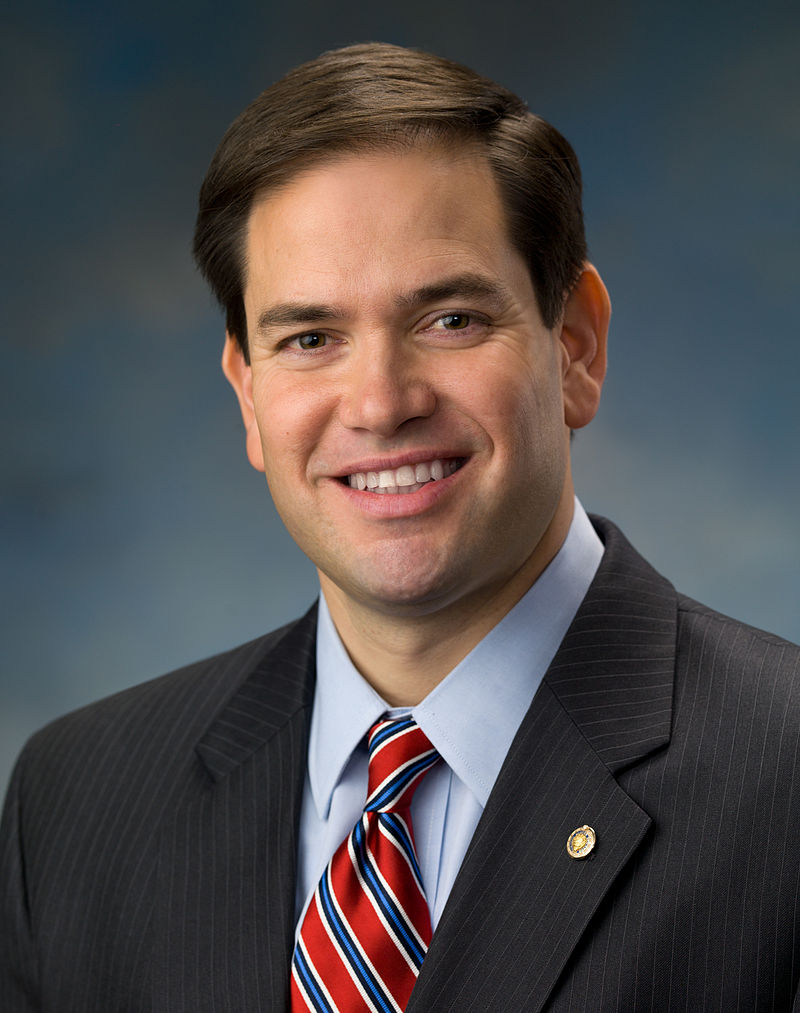

I would expect Florida Senator Marco Rubio to be a key person during this process. Rubio has been very vocal calling for the premium cigar exemption to make it into the Senate bill. With the recent hurricane having a major impact on Florida, cigars will most likely be taking a back seat on Rubio’s agenda over the next few weeks.

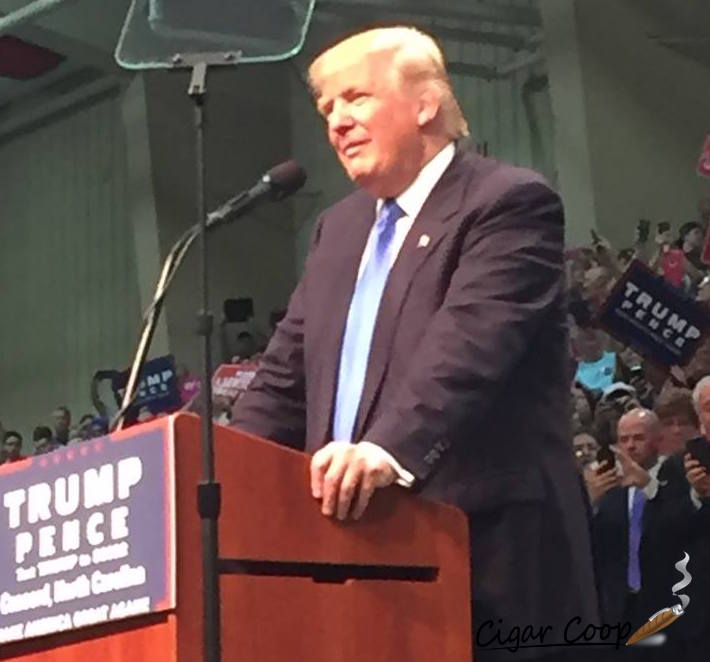

What Happens if President Trump Signs the Appropriations Process into Law?

I know this is getting ahead of things, but this is a very interesting question. Very simply if President Trump signs a bill with language exempting premium cigars, then premium cigars (subject to the definition under the law) will not be regulated during the Fiscal Year beginning October 1st, 2017 and ending September 30th, 2018.

In order for premium cigars to remain exempt from regulation following September 30th, 2018, one of two things must happen: 1) The language must make it onto the 2019 Fiscal Year Appropriations budget; 2) An exemption for premium cigars must be passed into law – under the current HR 564 and S 294 bills. The first scenario is more likely to happen because once such language for an exemption is included, it is likely to be reused next year. The second scenario has proven to be more difficult, and by the industry’s own omission the bills also served the purpose of creating awareness among members of Congress of the challenges the cigar industry is facing under FDA regulation.

But it does create an interesting possibility – basically a one-year window where the handcuffs are removed. Since Congress has till December 8th, 2017 to pass the Appropriations Bill it is possible that window is even smaller this year. I would expect many companies to employ a small batch release model – and try to catch lightning in a bottle. While there is a perception that there are “no new products”, that is incorrect. Many cigar companies have not halted innovation efforts. What has happened is many companies are holding back introducing these innovation efforts into market.

With the IPCPR Trade Show in July, a premium cigar exemption from the Deeming Rules could greatly change how any new products will be introduced to market. Given there is only a little over a two-month window after the trade show, it seems unlikely these products will be showcased at an IPCPR show. This could completely change the release cycle for products, and it could lead to IPCPR changing show dates.

In the scenario that it is only the predicate date change, that could prove to be very interesting. The reason is technically it is possible for the predicate date to be moved from 2007 to 2016 for Fiscal Year 2018, then reset back to 2007 for Fiscal Year 2019. Under this scenario, I think cigar companies will be very cautious here and focus on the pre-2007 predicate date products.

There is also a bill in Congress that calls for the predicate date to be changed to August 8, 2016. Recently in the summary judgment won by the FDA against Nicopure Labs LLC, the court set a precedent that this date could only be changed through an act of Congress. In the end, a predicate date change under the Appropriations process could put more attention on getting the actual date changed permanently through Congress.

What about Efforts Outside the Legislature?

Before this ruling, I’ve been pretty vocal. I don’t believe the lawsuit filed by the cigar industry will ever see opening arguments in Court. If an exemption is provided under the Appropriations process for Fiscal year 2018, combined with the FDA’s decision to re-examine the Deeming Rule on cigars, I would expect the lawsuit to be delayed or possibly stayed. The bottom line is, I don’t think the cigar industry wants to take on a costly and lengthy legal battle – and that’s exactly what the lawsuit would entail.

Regardless of whether or not the appropriations bill is passed into law, I expect the cigar industry to continue to keep communications with the Trump Administration open in terms of some sort of negotiation.

Final Thoughts

Many people were skeptical that the House would pass the language calling for the premium cigar exception. On top of that, while we can Monday Morning Quarterback the efforts of IPCPR, CRA, and the CAA, they have to be given some credit for getting us to the point where we are. The bottom line is that this was a positive step and the fact this made it through Congress is a big deal. However, the cigar industry still has a lot more work ahead of it.

Photo Credits: Cigar Coop, except where noted

The Scoop With Coop – KMA Talk Radio

April 20, 2018 @ 12:53 pm

[…] that language never made it into the U.S. Senate’s version of the bill. It was one of many things that needed to be reconciled as a single massive spending bill based on […]