Recently, Cigar Coop published an article where we looked at the correlation between media relations (press releases, press communication, and press relationships) and the number of cigars that landed on the leading cigar industry year-end lists – the Halfwheel Consensus and Cigar Aficionado. We also looked at the Cigar Coop’s own performance in this area. Following completion of that exercise, I decided to explore the performance of companies in general – and look specifically at which companies landed on these lists. What I uncovered is a big gap between the Halfwheel Consensus and the Cigar Aficionado Top 25 in terms of the best performing brands, with Cigar Coop falling somewhere in the middle.

While I am confident that press releases and press relationships played a direct role in the 2018 data, I did not collect such data between 2011 to 2018. As a result, while I can make some assumptions this played a significant role in the previous seven years before 2017, I don’t have the data to prove them.

The big gap is not something that is new. Charlie Minato, who curates the Halfwheel list, pointed out the divide between online media and Cigar Aficionado when he published his first Consensus list back in 2011. As I analyzed the data over the past eight years, I wanted to pinpoint where the divides have happened, and extrapolate some trends from the data collected.

For a complete list of the data collected in PDF form, click here.

The Data

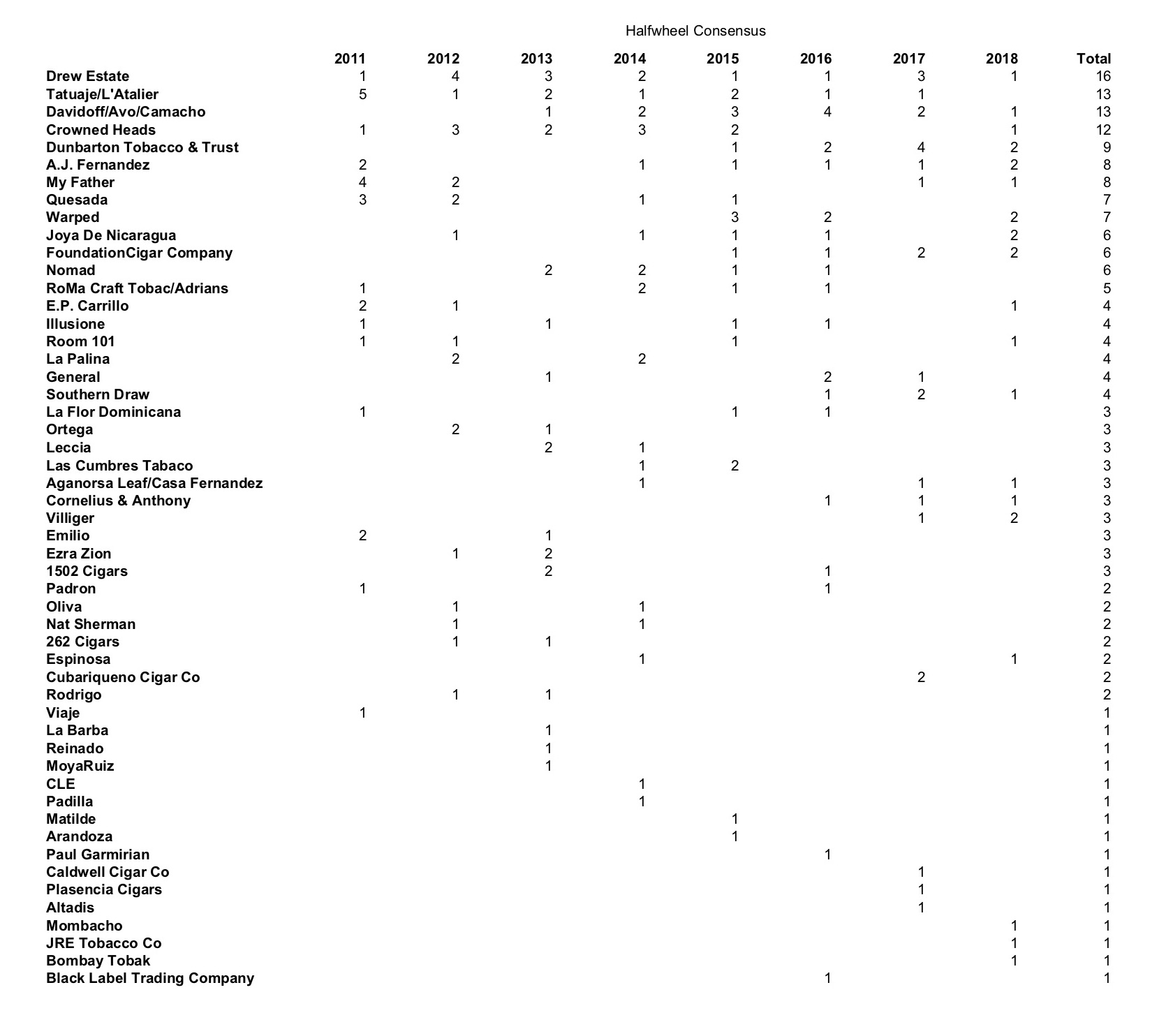

Halfwheel Consensus

Since 2011, Halfwheel has annually compiled a composite list of the leading media brands “best of the year” or “top xx of the year” cigar lists known as “The Consensus.” It includes both traditional print media and online media sources. It quickly became an industry barometer for assessing the best cigars of the year.

The Top 12

Below is a list of the Top 12 in terms of the number of times a company has landed on the Halfwheel Consensus between 2011 and 2018.

1-Drew Estate – 16

2-Tatuaje (including L’Atalier) – 13

(tie) Davidoff (including AVO & Camacho) – 13

4-Crowned Heads – 12

5-Dunbarton Tobacco & Trust – 9

6-AJ Fernandez Cigars – 8

(tie) My Father Cigars -8

8-Quesada Cigars – 7

(tie) Warped Cigars – 7

(tie) Joya de Nicaragua Cigars – 7

11-Foundation Cigar Company – 6

(tie) Nomad Cigar Company -6

Statistics at a Glance

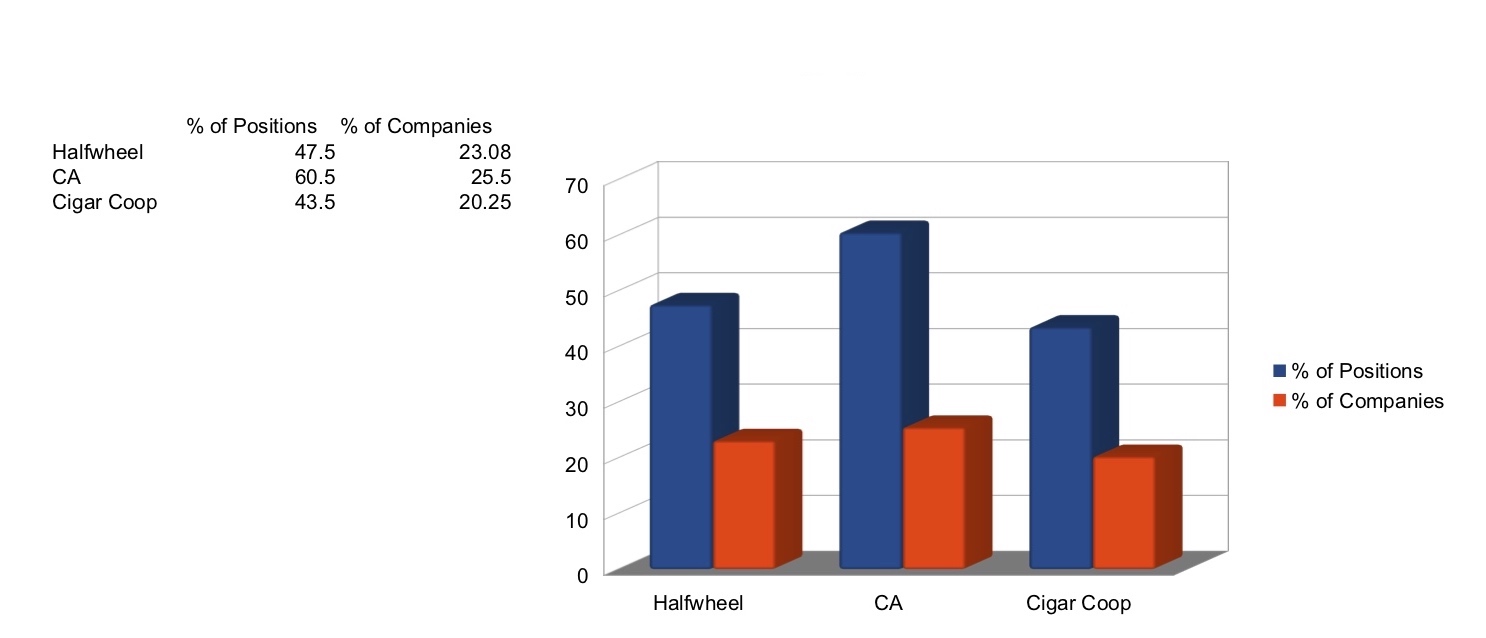

- 52 different companies have been represented on the Halfwheel Consensus during the period of 2011 to 2018.

- 47.5% of the spots landing on the Halfwheel Consensus were from Top 12 companies (23.08% of the companies).

Observations

- Drew Estate is the only company to secure a slot on the Halfwheel Consensus every year.

- Grouping companies that have been a part of House of Emilio/Boutiques Unified, there are a total of 18 spots secured on the Halfwheel Consensus. Nomad led all of these companies with six. This grouping totals 9% of the Consensus slots over eight years.

- Davidoff first appeared on the Consensus in 2013. This was the year the Davidoff Nicaragua was launched and perhaps coincidentally, Davidoff made a conscious attempt to reach out to online media.

- General Cigar, which has been a consistent supporter of online media, still has only managed four Consensus spots in eight years.

- While much has been made of Dunbarton Tobacco & Trust and Foundation Cigar Company’s impact on the Top 25 each year since 2015, Davidoff has had more Top 25 spots on the Consensus since then.

- Tatuaje (including L’Atelier Imports) missed the Consensus for the first time in 2018. Tatuaje’s 2011 performance on the Consensus is still the most dominant in the eight years, but ironically Tatuaje has never had a #1.

- Arturo Fuente and Ashton are the most notable companies to never land on the Halfwheel Consensus. In this author’s opinion, these companies also have been the least friendly to online media. J.C. Newman and Alec Bradley also do not have any Consensus rankings, but in the past two years, these companies have made a notable effort to start to connect with online media. Arturo Fuente also does not have many new releases.

- Habanos SA has never landed on the Halfwheel Consensus.

- You have to go back to 2011 to see the last time a single store exclusive has made the list. That year Adrian’s CroMagnon (which was still sold directly to consumers), My Father El Hijo (Smoke Inn), and Viaje Exclusivo Tower 45th (Tower Cigars) made it. One could argue the Man O War Armada was a shop exclusive as well (even though available through Meier & Dutch). These results emphasize my point that the overall quality and interest of the single store releases is not what it was eight years ago.

- For “the best of the best,” the TAA Cigars have performed horrendously when it comes to the Consensus. The Tatuaje TAA 2016 landed at #23 on the Consensus and is the only time a TAA landed a Consensus spot. I will infer this is due to little marketing, minimal communications to the media, and frankly underwhelming cigars.

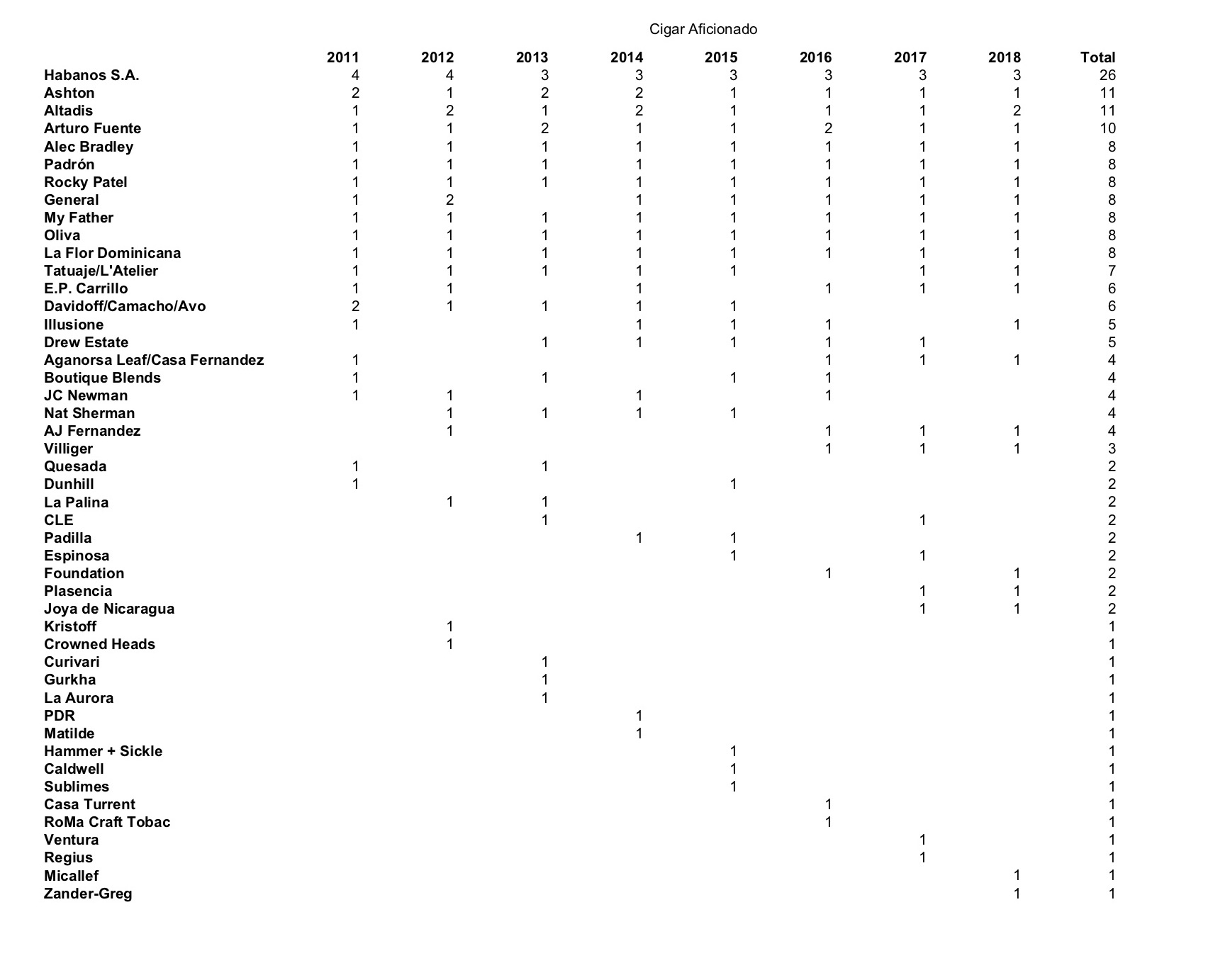

Cigar Aficionado Top 25

Since 2004, Cigar Aficionado has compiled its annual “Top 25 of Cigars of the Year” lists. Cigar Aficionado is a print publication with an online media arm. Despite the rise of online media outlets, Cigar Aficionado remains the leading publication for the cigar industry as does its Top 25 list. The Top 25 list is derived from a “tasting tournament” utilizing unbanded cigars which involves the participation of members of the Cigar Aficionado staff.

The Top 12

Note: For this exercise, the “Top 12 of the CA Top 25” represent the twelve companies that have landed on the CA Top 25 list the most often.

1-Habanos S.A. – 26

2-Ashton – 11

(tie) Altadis – 11

4-Arturo Fuente – 10

5-Alec Bradley – 8

(tie) Padrón – 8

(tie) Rocky Patel – 8

(tie) General – 8

(tie) My Father – 8

(tie) Oliva – 8

(tie) La Flor Dominicana – 8

12-Tatuaje (including L’Atelier) -7

Statistics at a Glance

- 47 different companies represented over eight years.

- 60.5% of the spots landing on the Cigar Aficionado Top 25 were from the Top 12 companies (25.5% of the companies).

Observations

- Ten companies have landed on the Cigar Aficionado Top 25 each year between 2011 and 2018. Four of those companies (Habanos S.A., Ashton, Altadis, and Arturo Fuente) have been on each year and have had multiple entries.

- Habanos S.A. dominated the company list with 26 – this accounts for 13% of the entries on the Cigar Aficionado Top 25. Habanos S.A. is the only company representing brands from Cuba.

- Except for Habanos S.A., for the period of 2011 through 2018 no company has had more than two entries on a single year’s Cigar Aficionado Top 25.

- Eliminating Habanos S.A., the other 11 companies still account for 47.5% of cigars on the Cigar Aficionado Top 25.

- Each of the Top 12 companies has been in business for fifteen years or more (this includes My Father when it was producing cigars under Don Pepin Garcia).

- Eight of the Top 12 companies have landed a #1 Cigar on a Cigar Aficionado Top 25.

- TAA and Shop Exclusive Cigars did not make this list, but in general, this has not been the focus of the cigars Cigar Aficionado has covered.

- For the Top 12 listed, each of those 12 companies has worked with Cigar Aficionado at one time or another to release exclusive and/or early press information to the detriment of other media outlets.

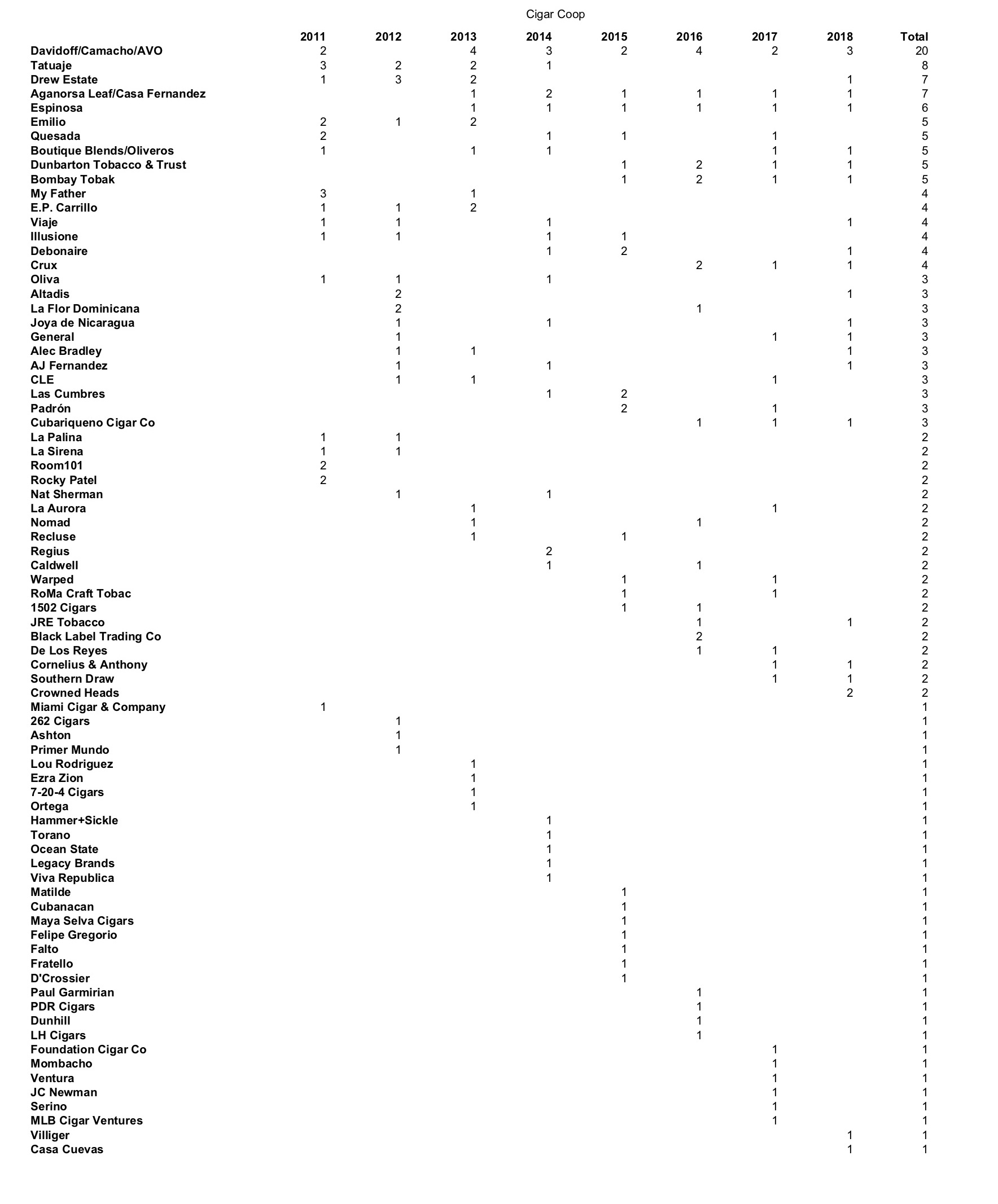

Cigar Coop Top 25

Our end of the year list is called “The Countdown” since we count down on a near-daily basis the Top 30 Cigars of the year. It’s a list determined and curated by this author. To keep consistency with the comparisons with the Halfwheel Consensus and Cigar Aficionado Top 25, data was only collected from cigars placing in positions 1 to 25.

The Top 16

Our Top 12 is actually 16 cigars due to a six-way tie for 11th place.

1-Davidoff/Camacho/AVO – 20

2-Tatuaje -8

3-Drew Estate -7

4-Aganorsa Leaf/Casa Fernandez -8

5-Espinosa – 6

6-Emilio – 5

(tie) Quesada – 5

(tie) Boutique Blends/Oliveros – 5

(tie) Dunbarton Tobacco & Trust – 5

(tie) Bombay Tobak -5

11-My Father – 4

(tie) E.P. Carrillo – 4

(tie) Viaje- 4

(tie) lllusione -4

(tie) Debonaire – 4

(tie) Crux -4

Statistics at a Glance

- A total of 78 different companies have landed on the Top 25 of Cigar Coop during the period of 2011 to 2018. This number would be higher if the entire Top 30 were used in this exercise.

- 43.5% of the spots landing on the Cigar Coop Top 25 were from 16 companies (20.25% of the companies).

Observations

- Of the Top 16 brands, none of them landed a Cigar Coop Cigar of the Year between 2011 and 2018, except for Crux (2016). Drew Estate and AVO won Cigar of the Year in 2009 (Pre-Cigar Coop) and 2010 respectively.

- 78 different companies ranked significantly higher than the numbers for the Consensus and Cigar Aficionado Top 25, but this was no surprise. This author believes the coverage done on Cigar Coop has always been wide in terms of the brands we cover. The goal on Coop is to be neither “too boutique” nor “too big company.”

- The Davidoff dominance even surprised this author when calculating the numbers. It was 2 1/2 times the second biggest, Tatuaje. One could make a fair case we reviewed more Davidoff than any other brand.

- While My Father made the Top 16, they have only slotted one cigar on the Coop Top 25 since 2011.

- Shop Exclusive, Regional, and TAA cigars were eliminated from eligibility in 2015. Prior to that, shop exclusives have done relatively well on the Countdown landing on the list each year from 2011 to 2014. TAA cigars have never made the Top 25, emphasizing again that the “best of the best” have underwhelmed.

- Much like the Consensus, Arturo Fuente has never landed on the Cigar Coop list. I’ll infer these reasons as being the same as for the Consensus: lack of marketing and infrequent releases.

- Habanos S.A. reviews only started in 2019, so it’s not a surprise there have been no spots claimed by the Cuban cigar company.

- It is important to know that this author curates the Cigar Coop Countdown, and in the end, it’s a fair argument to say this list reflects personal preferences.

The Cross Analysis

There is a Big Gap

The results tell the story and back up Minato’s statement from 2011. For the Top 12 on the Halfwheel Consensus versus Top 12 for the CA Top 25, there were only two companies that landed on both lists – My Father and Tatuaje/L’Atelier (which we will break down further in this article). These two companies also showed up on the Coop Top 16.

I believe there are three factors that play into why the data has come out the way it has. The first is pure merit – whether it’s a tasting tournament, subjective ranking, or even a crowd-sourced vote, most media outlets want to put the best-performing cigars on the list. The second is the frequency of release – companies that don’t have new releases on an annual basis didn’t do as well on the Consensus simply because older releases are not eligible (more detail in the Old vs. New section that follows). The third factor goes back to what we said earlier – the relationship between media and cigar companies.

A Difference in Philosophy

One thing that should be noted is that while there is a big gap between the selections as a part of the Consensus and the Cigar Aficionado Top 25, for the most part, different methodologies go into it. Last year we outlined several of these methodologies. In the end, that will dictate how the scores stacked up on a merit basis.

As mentioned above, the Halfwheel Consensus collects data from various media sources and builds a composite set. While there are various methodologies employed by these media sources, the most popular is the subjective approach (which Cigar Coop uses).

Cigar Aficionado uses a very different approach which is in the form of a tasting tournament. To my knowledge, it is the only major media outlet that does so. While on the surface this approach lends itself to the methodology based on merit, it still is dependent on the qualifiers for the tournament. These qualifiers come from cigars reviewed throughout the year on Cigar Aficionado, and arguably the Top 12 get more than their fair share of reviews.

If you look at the Consensus Top 12, all of the companies released a new cigar at least once a year between 2011 and 2018. On the other hand, you can look at the Top 12 for the Cigar Aficionado Top 25 and see companies like Padrón, Oliva, Ashton and Arturo Fuente – companies well known to skip years without a release. As a result, a tasting tournament like Cigar Aficionado allows brands like this to have an edge for placing in the Top 25.

The most telling fact is that five (Habanos SA, Ashton, Arturo Fuente, Alec Bradley, and Rocky Patel) of the Top 12 for the Cigar Aficionado Top 25 have never landed on the Halfwheel Consensus. At the same time, the number is only three (Crux, Debonaire, and Boutique Blends) for the top 16 of Cigar Coop’s Top 25 Countdown not landing on the Consensus.

One footnote: From 2011 to 2017, Cigar Coop relied on the new releases in a single year. Last year, Cigar Coop implemented a two-year window for eligible cigars for its Countdown.

Little Impact of Single Store/Single Store Chain Exclusives

The year 2011 saw several single store/single chain exclusives make the Halfwheel Consensus, but since then there had been none making the list. It’s fair to say there has been a major groundswell in terms of single store/single chain exclusives over the past eight years. One might think that this could have led to more single store exclusives making more media lists, thus leading to a Consensus spot. In reality, my feeling is the groundswell of these releases has diluted this segment of the market, thus resulting in these cigars not placing on the Consensus.

The groundswell is further complicated by the fact that many single store/single chain exclusives are geographically based. There have been some single store exclusive releases that have gained national traction depending on the retailer or manufacturer. Smoke Inn and Two Guys Smoke Shop have done an incredible job at marketing their shop exclusives. Some brands like Tatuaje and RoMa Craft Tobac don’t really need to do much other than a social media post and the surge in popularity begins. Despite these exceptions, the Consensus was void of single store/single chain releases.

Cigar Coop eliminated single store/single chain exclusives from its Countdown in 2015. This had to do more with a decision to focus the Cigar of the Year Countdown on more national releases. We also recognized that the single store/single chain exclusive market was difficult to cover with our infrastructure.

While they have never explicitly said it, Cigar Aficionado does not review single store/single chain exclusives. As a result, these cigars have not appeared on the Cigar Aficionado Top 25.

No Presence of the TAA

As mentioned, only one exclusive cigar for the Tobacconist Association of America (TAA) has landed on the Halfwheel Consensus. Like single store exclusives, the number of exclusive cigars to the TAA each year has grown. Yet, these cigars have never had traction in terms of making end-of-year lists.

One reason that can be attributed to the overall poor showing is the underwhelming job the TAA has done in promoting its cigars. Ultimately, there has been little news coverage of these releases, and frankly very few reviews. I think this mostly had to do with the fact that going back prior to 2011, there were not as many annual TAA releases as there are now. One could say you could get away with little press coverage in the days when there was one TAA release annually. Now with around a dozen a year, more promotion of these releases is needed.

Several years ago, The TAA Exclusive Cigars were described to me as “the best cigars by the best manufacturers for the best retailers.” Cigar Coop has reviewed nearly every TAA cigar released since 2014 and I think it’s fair to say these cigars have underperformed and have not lived up to expectations.

Notable Companies

Tatuaje and My Father

Two companies secured Top 12 spots on the Halfwheel Consensus, Cigar Aficionado Top 25, and Cigar Coop Countdown – and that was Tatuaje (including the brands of L’Atelier Imports) and My Father. While the strength of these brands could be traced back to the earlier days of the data collected here, these brands also still have released enough quality product to maintain their strong positions over the past eight years.

I believe increased competition on the boutique side of the fence slowed down Tatuaje’s presence on the Consensus and Cigar Coop. My Father has certainly had a strong relationship with print media, and in the end, I believe this factored into their decline on the Halfwheel Consensus.

Habanos S.A.

It wasn’t a total surprise that Habanos dominated the CA Top 25 list, and it wasn’t a total surprise that Habanos didn’t land a Consensus spot.

One could point to the fact that online media does not have access to Habanos products, but in general most online media do not even cover Habanos. It’s only in the last couple of years that Cigar Coop has covered Habanos, and it’s only in the past year where we have reviewed Habanos products.

Ashton, Padrón, Oliva, and Arturo Fuente

When it comes to Ashton, Padrón, Oliva, and Arturo Fuente – all four of these companies fall into the same category.

These companies accounted for 37 spots on the Cigar Aficionado Top 25. When comparing this to the Halfwheel Consensus, the gap is enormous as only four spots were captured on that list by the four above-named companies, and this includes no entries for Arturo Fuente and Ashton. On the Coop Countdown, these companies fared slightly better with a total of eight spots.

As mentioned earlier, these four companies are more competitive in a tasting tournament scenario. Combine that fact with a lack of online media relations and it has led to the gap.

La Aurora

If there is one company that was the most perplexing to me, it was La Aurora. Across the board, the company’s performance on the year-end lists from 2011 to 2018 was weak. This was something that was noted by Minato when he curated the first 2011 Consensus. It’s something that continued over the past eight years.

On Cigar Aficionado, if you go back to the early days of the Top 25, La Aurora was a staple, but there was only one La Aurora cigar to land on the Top 25 since 2011 (and that was an unlikely cigar with the Fernando Leon Family Reserve). For Cigar Coop, there were two spots for La Aurora, but that included a 2013 Cigar of the Year with the La Aurora Cien Anos Edición Especial and 2017 Cigar of the Year Runner Up with the La Aurora 107 Cosecha 2006 Corona Gorda.

Meanwhile, La Aurora has never landed a Consensus spot – and this is really surprising. La Aurora puts out good products. They are also a company that has maintained good relations with the media. In fact, if you go back to 2010 and 2011, La Aurora was one of the first companies to host media trips at its manufacturing facilities.

General

When it comes to General Cigar, most don’t think of it as a company that has had a presence on the Cigar Aficionado Top 25, but this is still a company that has almost made the list each year – and still has made it eight times overall. Much of the reason for this is that, minus the Flathead winning #3 Cigar of the Year in 2015, the high spots in the Top 25 for Cigar Aficionado have eluded them.

When it came to the Consensus, if you had suggested to me that General would only nail four spots in eight years, I would have told you I thought they’d do better than that. General has maintained excellent media relations over the years and has also hosted the media at its facilities. Even on Cigar Coop, the number was only three spots on the Countdown.

RoMa Craft Tobac

Founded in 2012, RoMa Craft Tobac has had a good run over the seven-year period from 2012 to 2018. This has included three spots on the Cigar Coop Countdown and a spot on the Cigar Aficionado Top 25. For a new and small company, the latter is a good achievement.

On the other hand, I was a little surprised to see RoMa Craft Tobac’s performance on the Consensus. The company just fell out of the overall Top 12 of the Halfwheel Consensus. This surprised me because the company has one of the most passionate fan-bases out there, and even though owner Skip Martin doesn’t like formal press releases, he and his company have maintained excellent media relations and been a juggernaut on social media – so I’m not inclined to believe that is the reason.

Bottom line, I’m still perplexed that RoMa Craft Tobac landed outside the Top 12 of the Consensus. The company has certainly produced excellent product from a merit and value standpoint. Considering companies like Dunbarton Tobacco & Trust, Foundation Cigar Company, and Warped Cigars (in its present form) weren’t present in 2012 when RoMa Craft Tobac was founded, I’m surprised RoMa Craft wasn’t rated higher.

Espinosa

When it comes to the Halfwheel Consensus and Cigar Aficionado Top 25, Espinosa Cigars landed two spots on each list. Both of these numbers seemed low to me. Espinosa certainly has maintained excellent relations with the media, and has had plenty of their cigars reviewed with very good ratings. Based on that fact alone, I would think they would have secured additional spots on the Halfwheel Consensus.

Espinosa has landed on the Cigar Coop Countdown the past six consecutive years, so the numbers on the Halfwheel Consensus and Cigar Aficionado Top 25 had me perplexed.

Final Thoughts

The older and established companies have dominated the Top 12 of the Top 25 over the past two decades. Companies like Padrón, Arturo Fuente, and Oliva have been a model of consistency year after year and do not need to focus on having a new release annually. Since Cigar Aficionado doesn’t use a single calendar year limitation for its end of the year list, the timeline benefits these companies.

While it incorporates print media, the Halfwheel Consensus still shows a strong reflection from the online media end. Smaller companies that normally might not have the same amount of coverage from a large print publication like Cigar Aficionado have found a home. These companies have worked with online media and have used them as influencers. Companies such as Drew Estate, Tatuaje, Quesada, Joya de Nicaragua, My Father, and AJ Fernandez Cigars have all had good coverage and had good relationships with Cigar Aficionado – and still were a big part of the Top 12 of the Halfwheel Consensus.

While Cigar Coop is far from perfect, I really do like the fact we landed somewhere in the middle of the Halfwheel Consensus and Cigar Aficionado Top 25.

The New York Times came up with the slogan “all the news that’s fit to print” and I think that applies to the subject of this article. There are a lot of good cigars, but ultimately there are only so many real estate slots for a Top 25. Ultimately, relationships are going to come into play. Maybe a few smaller companies will get bigger and ultimately have a stronger relationship on the Cigar Aficionado side, but in the end, I don’t see anything to indicate the gap will close in terms of the Top 25 lists.

December 2, 2019 @ 11:54 am

“Except for Habanos S.A., no company has had more than two entries on a single year’s Cigar Aficionado Top 25.”

Not true. In 2005 there were three from Altadis. In 2006, three from Altadis. Three from General in 2008. Etc. etc. Probably more years too. It’s all in the archives so you can look for yourself.

December 2, 2019 @ 8:38 pm

Yes you are correct, but we only sampled data from 2011 through 2018 for this exercise (which was taken from the CA Archives). I have added a footnote to this comment.

December 3, 2019 @ 3:15 am

As I mentioned a few weeks ago, articles like this are super interesting to me and I applaud the work here.

I think it’s worth pointing out that the first few years of The Consensus are a lot different now. The results are still tabulated the same, but starting with the 2014 version, I decided to take publications that published multiple lists by multiple authors and tabulate those results together. (More specifically, I divided the scores each cigar got from each list by the number of lists by that publication; i.e. if a cigar got first place on one author’s list, but the blog’s other list had a different cigar, each first place vote got 12.5 points instead of 25 for a singular list publication.)

I’m guessing the results of the first few years would be different, maybe not for the top five or 10 cigars, but certainly some of the bottom parts of the list would be different as publications certainly skew to certain brands.

I also find it interesting just how popular The Consensus has gotten with parts of cigar media. I get that it’s very much inside baseball, but I have far more conversations about The Consensus with cigar media people than I do with cigar manufacturers. (And I have a lot less conversations with cigar media than cigar manufacturers.)

—

Some opinions:

1. On Who’s In — For six of the eight years of The Consensus, Drew Estate et al. has won. (Drew Estate et al. being DE; Joya de Nicaragua, which DE distributes in the U.S.; or companies run by former DE employees Dunbarton Tobacco & Trust and Foundation.)

As I’ve mentioned before, I think much of that is a testament to DE’s outreach to media and its relative openness to working with media in just about every way imaginable. I imagine that Dunbarton and Foundation would have fared well regardless, but the profiles of both company’s founders was increased immensely compared to how most companies start in the cigar business.

2. On Who’s Not In — Ashton and Perdomo are two cases where I think the general lack of attention to media at large (particularly the smaller media outlets that make up so much of the data pool) and the lack of new cigars have hurt them.

For example, Perdomo didn’t even mention that its new release began shipping a month or so ago. That’s not helpful if you want to place on The Consensus.

Altadis U.S.A. is somewhat of a different case (it made it once), one that is probably related to the quality of its cigars, which don’t seem to fair particularly well in reviews from non-magazines.

3. On The TAA — I don’t have any data (yikes) to back this up, but the TAA cigars by-in-large don’t get reviewed. The Tatuaje TAA gets reviewed by a number of outlets and The Angel’s Anvil has gotten a fair number of reviews. Outside of that, most the TAA releases seem to get ignored by the bulk of cigar media, which I’m guessing is at least somewhat related to the fact that so many of them ship right around IPCPR and therefore they sort of end being an afterthought.

Why review the CAO TAA release when General just released 18 new cigars which you got samples for?

4. Shout Out Skip Martin — At some point Skip mentioned just how many of the companies that are on The Consensus that aren’t around, or at least are much more diminished: Ortega, Leccia, Las Cumbres, Cornelius & Anthony, 262, Rodrigo and Reinado are all examples of companies that fit that bill in my opinion.

I’m not sure what to make of all of that but it’s interesting to look at the list from that perspective and certainly I think in two years when The Consensus turns 10, it will be curious to see a decade of data and progression.

5. The Big Problem With Lists — You mention CA’s tournament-style list and its uniqueness, but I also think it’s worth pointing out that The Consensus isn’t about the quality of lists, though it’s one of the few times per year any public discussion about issues with lists individually seems to happen.

I have a lot of complaints about how lists are produced, but the one that I don’t think is debatable is that media outlets should do a better job of explaining how their list was created.

With multiple people participating in a single list, it’s so much easier to create less skewed results. But for those people who just sit down one night in December and think about what should be on their lists, I would imagine the methodology is oftentimes not great.

I would struggle immensely to come up with a Top 10 list of cigars I’ve smoked right now, particularly in a world where the data wasn’t being stored. And in a world where someone is just subjectively ranking cigars, instead of scoring them, there’s a tendency for a lot of biases to skew results poorly.

Some people want to make sure they aren’t left out and put cigars they see on other lists. Others want to go the hipster route and put weird things on it. Then Villiger sends a bottle of liquor with some samples. Drew Estate sends a standing ashtray. Your local shop owner is talking about how much they love the newest Davidoff Year of the Whatever, etc.

All of those things play a role in a world where it’s just a ranking. (Not to mention about what happens if you just forget. How many people are actually looking at every cigar they reviewed/smoked that would be eligible before coming up with their Top 10?)

And then there’s the problems with the magazines in particular. There’s no indication based on the CA Top 25 page that there might be some rule about how companies can only place one cigar on the list unless its Habanos S.A. That’s a massive issue in my opinion.

Imagine if the College Football Playoff Committee had the same rule but never disclosed it?

Bias exists in everything we do, but not disclosing methodology isn’t a bias, it’s just a poor practice.

—

I’ve long said The Consensus is best served as a tool to understand the relationship between cigar companies and cigar media in a given year.

I think that’s still true, but from the other side of the keyboard, it’s also a great way to get a bird’s-eye view of how the consumers of media (whether they be consumers, retailers, manufacturers or media themselves) interact with cigar media content collectively.

I cannot wait to see The Consensus for 2019, it’s always an exciting process with oftentimes surprising results. I also look forward to taking a lot of deep dives similar to this once the 10th version is published.

December 8, 2019 @ 3:02 pm

How about the fact that the companies that advertise in CA routinely appear in the top 25 year after year, even after turning out stinker after stinker. Money talks, plain and simple.