In Cigar Coop tradition, we close out the calendar year by looking at the top 12 cigar industry stories and themes for 2024. This is the 14th consecutive year of this recap.

Unlike how we consider cigars for our Cigar of the Year Countdown, the Top 12 Stories and Themes are based on the actual calendar year. These stories are individual stories or ones that are multifaceted. Some even overlap. Most importantly, they are the ones that had the most significant impact on the cigar industry as a whole.

The Top 12 Stories and Themes for 2024 are not listed in any particular order of importance. Instead, they have been arranged logically to improve flow.

Major Changes for the PCA Trade Show in 2024

The annual Premium Cigar Association Trade Show and Convention underwent three major changes, which were by far the most significant changes I have seen since covering the Trade Show.

- The move to the Spring: Traditionally, the Trade Show has been a July/August event. Pressure from both the manufacturer and retailer community led to a move to the spring.

- The elimination of the Half-Day: For many years, Day 4 of the PCA was a half-day. After several years of very slow foot traffic on that day, the PCA decided to eliminate it.

- The move to the Las Vegas Convention Center: It has been said that this was tied to the move to the spring, as the traditional venue for the past five years, the Venetian Expo Center, was not offering a spring date.

Editor’s Comments

The majority of people had a positive response to all three changes. However, there was little support when the trade show relocated from the Venetian to the Las Vegas Convention Center in 2017. The 2017 move received mixed reviews, primarily due to issues with the host hotels rather than the Convention Center itself. Many attendees voiced complaints about the Westgate Hotel in 2017. For 2024, Resorts World was included as an option, leading to a more satisfactory experience.

The group most upset regarding the move to the spring and the half-day elimination was cigar media. Many cigar media people are already busy with festivals, factory trips, and other events in the year’s first quarter. In addition, the media has lost a full day on the show floor (although PCA has tried to remedy this through extended hours). Still, the vibe I read was that the move to the spring was a positive to the collective cigar community.

One other indirect result of the move to the spring is that, for the most part, the Big Four (Altadis, Davidoff, Drew Estate, and STG) have all cited the Trade Show’s move to the spring as why they returned to the Trade Show.

These changes have not had a considerable impact on the numbers. For 2024, there was only a 5.46% increase in accounts and a 1.25% increase in badges. These are not huge numbers. I would have expected a slightly more significant boost. Still, PCA is approaching pre-COVID attendee numbers, so I can understand their satisfaction.

| Year | Accounts | % Change (Acct) | Badges | % Change (Bdg) |

| 2022 | 772 | 2005 | ||

| 2023 | 806 | 4.40% | 2156 | 7.53% |

| 2024 | 850 | 5.46% | 2183 | 1.25% |

PCA could face challenges in achieving growth in 2025. Many attendees are not excited about New Orleans as a venue. Some recall the previous smoking restrictions, others are worried about the ability to smoke after hours, and several long-time attendees have negative memories of the last PCA Trade Show held there in 2015. I am going to look at the glass half-full here and have confidence in the leadership that they will put on a good show in New Orleans.

The PCA Alliance Launches

The Premium Cigar Association (PCA) announced a significant change to its membership offerings under the PCA Alliance banner. The PCA Alliance offers membership tiers to individuals outside the premium cigar industry for the first time.

Until this announcement, PCA offered memberships only to retailers, brand owners, manufacturers, distributors, brokers, and media. These memberships focused on tobacco and/or tobacco accessories in all these scenarios. The PCA Alliance now expands this by offering non-tobacco businesses and consumer tiers. The idea here is to allow these stakeholders to support PCA’s advocacy programs and provide these members with select PCA benefits. One benefit that PCA Alliance members will not receive is access to the annual Trade Show and Convention. The PCA states these membership contributions will support the PCA Industry Defense Fund.

At the time of the announcement, Joshua Habursky, Executive Director for the Premium Cigar Association, said, “Retailers are at the forefront in interactions and sales of premium cigars and pipe tobacco with other small businesses like golf courses, restaurants, and other businesses that serve and offer their customers premium cigars. So are consumers that support lounges, bars, and other premium cigar-carrying businesses. The Alliance membership empowers retailers, small businesses, and consumers to get involved in the PCA’s cause. This is an important step in growing our advocacy army and informing a wider audience on what is going on from a legislative and regulatory perspective and where they might be able to be involved.”

Editor’s Comments

When the ill-fated CigarCon program attempted to get off the ground in 2018, former PCA Executive Director Scott Pearce stated that the goal of PCA was to become a “full-service” organization. Much of the justification for CigarCon aimed to expand the number of members beyond the usual retailer, manufacturer, etc. Although there was a rationale for doing so, we know other issues ultimately did in CigarCon.

At the same time, becoming a full-service organization took longer, thanks to the COVID-19 pandemic. The PCA Alliance probably would have happened sooner if it weren’t for the pandemic. Ultimately, the PCA Alliance represents a key program in strengthening the PCA as a full-service organization. In our interview with Executive Director Joshua Habursky, he was very transparent about the goals of the PCA Alliance. He also said it would require some time to build and ultimately strengthen the value proposition for these members.

Overall, the PCA Alliance represents progress, but it’s important to recognize that consumer involvement in the PCA is a contentious issue within the cigar industry. The debate primarily centers on whether consumers should be allowed to attend the PCA Trade Show. The PCA Alliance has reignited this discussion, even though the PCA has clearly stated that this is not the case. This situation indicates that the PCA should handle the topic of consumer involvement with kid gloves.

Fuente y Padrón Legends Arrives

On October 9th, 2020, news broke of what would be the highest-profile collaboration between two cigar companies to date: the Fuente y Padrón Legends. This collaboration between Arturo Fuente and Padrón Cigars was met with a lot of interest. Nearly three and a half years later, on March 20th, 2024 (the eve of the PCA Trade Show), Legends started to arrive at retailers.

Each principal blended a cigar for this project to honor the other principal’s father. In other words, Jorge Padrón created a cigar to honor Carlos Fuente Sr., and Carlito Fuente created a cigar to honor Jose Orlando Padrón. The cigars come in a collectible 40-count box/humidor featuring two 20-count trays of each blend.

While Legends was announced in October 2020, the project was not launched until July 2022 at PCA 2022. Still, it took some time to reach retail stores. Last year, Legends started shipping from the Dominican Republic on Thanksgiving Weekend 2023. However, one of the containers was damaged during transit to the U.S., delaying retailers’ receipt of their shipments until March 2024.

A unique aspect of this project is that Arturo Fuente and Padrón collaborated on distribution, specifically by allocating the Legends cigars to their key customers. The cigars are priced at approximately $175.00, and there is a charitable component to the initiative. The net profits from the project will support both the Padron Family Foundation and the Cigar Family Charitable Foundation.

Editor’s Comments

As stated above, this is the highest-profile collaboration between two companies in the cigar industry. I’m not sure any cigar industry collaborations can top this one. In the end, this is a great thing for the cigar industry. Unfortunately, this project was met with criticism – namely, the price point and the time it took to get this to market. This criticism is not fair. This project has been something truly special to the cigar industry, and I hope we see more of these cigars in the years to come.

The Luxury Cigar Market Expands

While it wasn’t a new trend or theme for 2024, the ultra-premium cigar market continued to grow. The number of cigars priced at $30.00 or more increased, and the number of cigars priced at $100.00 or more did not slow down.

These are some (not a complete list) of the ultra-premium releases we have seen in 2024 that started at the $30.00 price point.

- Altadis U.S.A.: Montecristo 1935 Anniversary Edición Doble Diamante ($150.00 SRP/cigar)

- Arturo Fuente: Some Opus X 25s and OpusX 2020 (Dubai) are reaching retailers. While pricing has not been confirmed, the pricing does fall above the $30.00 price point for this category. Arturo Fuente has also tapped into this space through the Assouline Book, Impossible Collection, and Dream to Dynasty Collection.

- Davidoff: Several releases over $50.00, but ultimately led by Davidoff Oro Blanco Special Reserve ($750.00 SRP/cigar)

- El Septimo: Vartan the Dragon ($98.00 SRP/cigar)

- Fuente y Padrón Legends: (See previous section) ($178.00 SRP/cigar)

- La Aurora: Hors D’Age 2022 Limited Edition ($30.00 SRP/cigar)

- La Union: The My Father – Tatuaje Collaboration ($60.00 SRP/cigar)

- La Flor Dominicana: LFD 30 Years ($30.00 SRP/cigar)

- Manny Irate Enterprises: OpusX Society ($90.00 SRP/cigar)

- Padrón 60th: Padron 60th ($75.00/cigar)

- Peter James and Luciano Cigars: Emergence ($60.00 – $66.00 SRP/cigar)

- Plasencia Cigars: Plasencia Alma Del Fuego Ometepe Edición Limitada ($100.00 SRP/cigar) and El Año de la Culebra ($49.00 SRP/cigar)

- Prometheus: God of Fire 20th Anniversary Cigars ($53.95 SRP/cigar)

- Rocky Patel Premium Cigars: Rocky Patel Year of the Dragon ($35.00/ SRP/cigar) is the company’s second-most expensive release to date behind Conviction ($100.00 SRP/cigar)

- Warped Cigars: Gellis Family Piece Unique ($40.00 SRP/cigar)

On top of that, Habanos S.A. continues to play in this space. Their products remain in high demand even following price adjustments a few years ago.

Editor’s Comments

Premium cigars have been embraced as a luxury item for many years. In 2018, Rocky Patel, the owner of Rocky Patel Premium Cigars, made a national television appearance on Tucker Carlson Live on the Fox News Channel. This segment lasted less than five minutes, but during the show, Patel highlighted a well-known point: premium cigars are luxury items, similar to cars, watches, and fine spirits. Just like these other luxury products, select premium cigars are increasingly being offered at high prices. Companies justify these costs for various reasons, such as the quality of tobacco, skilled labor, and packaging. However, the validity of these reasons can be debated extensively from different perspectives.

It’s important to know that these cigars are not for the everyday smoker and are not meant to be sold by every retailer. They are targeted at consumers who indulge in a more extravagant lifestyle. One thing that has been proven is that there is a market for these cigars, though it’s for a much smaller percentage of an already small market.

Nevertheless, a lot of companies are tapping into this space. These fall into three categories:

- Companies built around luxury releases such as Davidoff, Arturo Fuente, and Habanos S.A..

- Established companies looking to do more in this space. Plasencia Cigars and Altadis fall into this category.

- Companies with a hope and dream of playing into this space: You can figure out who these guys are, companies that are not established coming out with expensive cigars.

The irony is that many consumers, pundits, retailers, media, and manufacturers have complained that this is bad for the cigar industry. In this author’s opinion, if it gets people talking about our industry, it’s good for everyone involved.

Davidoff 2024

When I began to think of companies with an interesting 2024, Davidoff stood out, particularly in the Davidoff Americas division. Here is just a snapshot:

- Davidoff Americas Leadership Change: In May, Davidoff of Americas President Dylan Austin left. Zak Medwin, Commercial Director, and Lana Fraser, Director Head of Marketing & Retail, assumed interim responsibility as President and Vice President of Davidoff of Geneva, USA.

- Chief Commercial Officer Leadership Change: Luc Hyvernat parted ways with the company.

- Davidoff Returning to PCA in 2025: Davidoff was the last hold-out of the Big Four regarding returning to the Trade Show. This move occurred in August 2024.

- Davidoff Strengthens its position in the Luxury Market: Releases such as Davidoff Oro Blanco Special Reserve, Davidoff Year of the Snake Limited Edition 2025, Davidoff Grand Cru Diademas Finas, and Davidoff Maduro support this statement.

- Expansion of Production Facilities: Davidoff has announced that it is expanding its manufacturing facilities in the Dominican Republic. The company plans to open a new Blending Center, a new Short Filler Center, and a new employee cafeteria/lounge.

It is worth noting that the previous year, parent company Oettinger Davidoff AG reported record revenues of CHF 546.2 million, representing an increase of 10.5%.

Editor’s Comments

In addition to generating record revenue the year before, the company experienced some changes in leadership, including the departures of Chief Commercial Officer Luc Hyvernat and Americas President Dylan Austin. Following Austin’s exit, Davidoff announced that they would be returning to the PCA after a five-year absence. In a 2020 interview, Austin had expressed a lack of enthusiasm for returning to the trade show. Given that this interview took place three and a half years ago, it’s difficult to determine whether he would have supported Davidoff’s decision to return to the PCA.

Regarding products, Davidoff has returned to its luxury roots, moving away from the craft-paper bundle Vault series to focus on high-quality cigar products. After several permutations of the brand’s vision, Zino seems to have found its niché to be a lower-priced store offering with Zino Nicaragua. I still prefer Zino to be a luxury brand, but one can’t argue with Davidoff’s success with it.

Finally, I think some excitement needs to happen between AVO and Camacho. I hoped the D-Nice collaboration in 2024 would do that for AVO, but it didn’t. Hopefully, we will see that in 2025. I also think the core Davidoff line really needs a new regular production offering.

Laudisi Acquires Caldwell and Lost & Found

Laudisi Enterprises acquired Caldwell Cigar Company and Lost & Found Cigars on March 1st. As part of the acquisition, Caldwell co-founders Robert Caldwell and Juan Jaramillo joined the senior management team at Laudisi Enterprises and will lead the new Caldwell Cigar division.

Caldwell Cigar Company was founded in 2013, several months after Caldwell split with Camacho Cigars. While Caldwell and Jaramillo are partners in Caldwell Cigar Company, Lost & Found has been a separate venture. Like Caldwell Cigar Company, Lost & Found began in 2013. The company was started as a partnership between Caldwell, Tony Bellatto, and Jaclyn Sears. Lost & Found originally had a business model of finding and repackaging old cigars. In 2022, Lost & Found changed its focus to small-batch products.

Sykes Wilford founded Laudisi Enterprises, a diversified tobacco company primarily recognized for its pipe brands, including Cornell & Diehl and Peterson, as well as its online store, Smokingpipes.com. Laudisi also operates a brick-and-mortar shop in South Carolina called Low Country Tobacco. In recent years, the company has expanded into the cigar market through Smokingpipes.com and Low Country Tobacco. The acquisition of the Caldwell and Lost & Found brands provided Laudisi with a ready-made presence in the cigar industry.

In addition to the acquisition, Laudisi assumed distribution for Tony Bellatto’s La Barba Cigars. La Barba had been previously distributed by Caldwell’s distribution arm, Down and Back.

Editor’s Comments

The cigar industry loves a good acquisition and loves it even more when it’s not a big guy swallowing a little guy. Laudisi is by no means a small player, but it is also not a big corporate entity.

Robert Caldwell has dedicated over a decade to establishing Caldwell and Lost & Found. Throughout this period, he has positively disrupted and transformed the cigar industry. Caldwell introduced a level of creativity and confidence that had not been seen before. As I mentioned in my Story of the Decade, he was part of the team that changed the industry with Lost & Found. At the same time, it’s hard to build a company and get it to the next level. Laudisi is undoubtedly a bigger enterprise and gives Caldwell the resources needed to get to that next level.

At the same time, Caldwell can concentrate on his exceptional creativity. Hopefully, Caldwell can continue to be himself. Ultimately, I believe this acquisition is a significant win-win for all parties involved.

Scandinavian Tobacco Group Acquires Mac Baren

Scandinavian Tobacco Group (STG)’s significant acquisition for 2024 wasn’t a cigar company but a company focused on products such as pipe tobacco and nicotine pouches. While on the surface, this didn’t seem like it touched the premium cigar space, that wasn’t the case,

Mac Baren was founded in 1826. Its companies include pipe tobacco brands such as Mac Baren, Amphora, and Holger Danske and fine-cut tobacco brands like Amsterdamer, Choice, and Opal. The company also produces and sells nicotine pouches using the brands ACE and GRITT. Mac Baren’s products are sold in 74 countries, with most net sales generated in the US, Denmark, and Germany. Other key markets include the UK, France, Spain and Italy. The company is based in Svendborg, Denmark, with production facilities in Denmark and Richmond, Virginia, and has approximately 200 full-time employees worldwide.

Mac Baren also owns the U.S.-based Sutliff Tobacco. In 2013, Mac Baren acquired Altadis’ pipe tobacco business and began operating it under that division’s original name, Sutliff Tobacco. Over the past few years, Sutliff Tobacco has also distributed several boutique cigar brands. Notable brands Sutliff handles include Matilde, Patina, Regius, and many others.

Sutliff Tobacco has not made any official statement about potentially exiting cigar distribution. Meanwhile, some companies where Sutliff was handling distribution informed Cigar Coop that they were told Sutliff would no longer provide such services at year-end. Meanwhile, City of Palms, a distribution company in Florida, has already taken over distribution for Matilde, Patina, Drunk Chicken, and Lampert.

The acquisition’s value, on a debt—and cash-free basis (the enterprise value), is DKK 535 million (~USD 75 million). STG acquired all of Mac Baren Tobacco Company A/S’s shares from Halberg A/S.

Editor’s Comments

I wasn’t sure at first whether this should be included in the Top 12 for 2024. In the end, I decided to include it for two reasons. First, it significantly affected several smaller cigar companies in terms of distribution. The second reason is even more important: this was STG’s major acquisition. At 75 million dollars, it was slightly more than STG’s acquisition of Alec Bradley Ultimately, this acquisition reveals more about STG’s direction as a parent company than anything else.

Micallef/All Saints End Unified Sales Alliance

About a month after both companies occupied adjacent booths at the Premium Cigar Association (PCA) Trade Show, Micallef and All Saints Cigars announced they were ending their unified sales alliance.

The alliance would only last eight months. In August 2023, Micallef and All Saints announced they would unify their sales force under a single team. As part of the arrangement, All Saints Cigars co-owner Micky Pegg became President of Micallef Sales and ran the combined sales team. While the sales teams were brought under one umbrella, All Saints and Micallef have always remained independently owned.

The split was announced in April 2024, and the two companies would separate by June. Micallef would retain its in-house sales force. Dan Thompson, President of Micallef Cigars, has assumed more direct responsibilities for the sales organization.

Editor’s Comments

Micallef and All Saints were not the first to establish such an alliance. There have been successful ones, such as Fuente and Newman, but unfortunately, the track record for this kind of alliance isn’t optimal. At the same time, it proves arrangements like this are complex – even for smaller companies.

New Executive Leadership in the Three Trade Organizations

The three major trade associations in the industry each experienced a change in leadership. In all these cases, the new leaders were familiar faces.

Mike Copperman, Cigar Rights of America

The year started with Mike Copperman being named Executive Director for Cigar Rights of America (CRA).

Copperman has been with CRA since 2011 when he served as the Legislative and Regulatory Affairs Director. He filled the position that had been vacant since November 2020, when Glynn Loope stepped down.

Scott Pearce, Cigar Association of America

About a month after the 2024 PCA Trade Show concluded, it was announced that Scott Pearce, the Executive Director of the Premium Cigar Association (PCA), would be leaving his position. However, Pearce is not leaving the industry; instead, he will serve as the new president of the Cigar Association of America (CAA). He is replacing David Ozgo, who departed earlier this year.

Joshua Habursky, Premium Cigar Association

When Pearce stepped down, the PCA immediately appointed Joshua Habursky, Director of Government Affairs and Deputy Executive Director, as its Interim Executive Director. Less than two months later, the interim tag was removed, and Habursky was officially named full-time PCA Executive Director.

Editor’s Comments

These were all welcome changes in this editor/author’s mind. The best part is that they will all be filled with experienced cigar industry leaders. The cigar industry cannot afford to have someone learn on the job.

Mike Copperman had been with CRA for over a decade and, for all practical purposes, was the #2 guy there for many years. The Executive Director position had been vacant for too long, so it was good to see it closed.

Scott Pearce’s move to CAA surprised many. It gives CAA leadership to someone who has served the cigar industry for five years. Pearce is credited with navigating the PCA through some tough times (Pandemic, Big Four exit). While he will be missed at PCA, I’m pleased he will remain in the industry.

It was also great to see Joshua Habursky quickly get the PCA Executive Director position. The past three vacancies in this position saw long, drawn-out searches for what was then IPCPR. The PCA Board’s quick action was good, and they picked the right man for the job.

The Chevron Ruling

The premium cigar industry got a win from a U.S. Supreme Court ruling that wasn’t tied to tobacco.

On June 28th, 2024, the United States Supreme Court struck down the Chevron Deference. The ruling cut back sharply on the power of federal agencies to interpret the laws they administer. The Chevron Deference precedent was created by the Court in the 1984 case Chevron v. NRDC. Chevron essentially allowed agencies wide latitude in interpreting the scope of their own authority in cases where laws passed by Congress were ambiguous. It required judges to strongly defer to the agency’s interpretations of vague statutory language. The ruling emphasizes that courts, not agencies, will interpret any given law’s reasonable scope of authority.

The ruling is expected to have a ripple effect across regulations from different agencies. This includes healthcare, the environment, and what the Food & Drug Administration (FDA) covers. The premium cigar industry is celebrating the ruling as the industry is subject to the FDA’s rulemaking.

Editor’s Comments

Following the rule, CRA Executive Director Mike Copperman said, “Premium hand-rolled cigars are an artisanal product which does not possess the health effects, nor youth usage concerns, that would warrant regulation by the FDA. It is our sincere hope that today’s momentous decision represents the beginning of a more transparent, fair, and level regulatory environment where FDA prioritizes the science and acknowledges the reality that premium hand-rolled cigars ought to be exempt from onerous regulation.”

Copperman’s statement is on point. However, what the “more transparent, fair, and level regulatory environment” actually means is still somewhat unknown. It will be worth watching this, especially if the FDA returns to the drawing board regarding rule-making for premium cigar regulation.

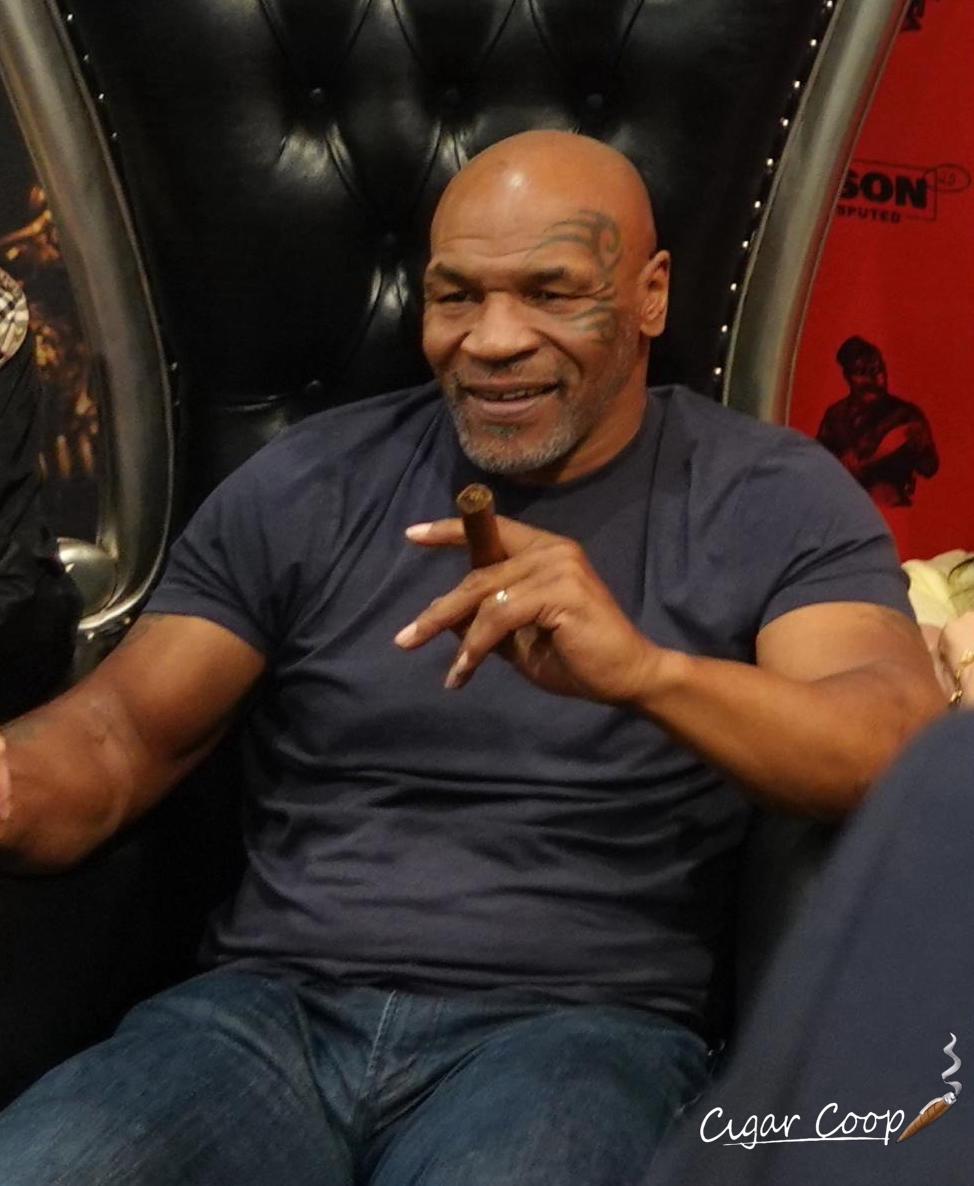

Mike Tyson

The last few years have seen a rise in mainstream collaborations. This year, former heavyweight boxing champion Mike Tyson, one of the biggest celebrities of the past 40 years, entered the cigar business. Tyson’s LGNDS team and Gurkha Cigars worked together on the Tyson 2.0 Undisputed project.

Tyson 2.0 Undisputed line features two blends: Maduro (San Andres) and Habano. The Maduro is encased in a black-top box, while the Habano is encased in a gold-metallic one. The Tyson 2.0 Undisputed by Gurkha Cigars is made at Tabacalera El Artista and has an MSRP of $19.00-$19.90.

In addition, Tyson made a short appearance at the 2024 PCA Trade Show at the Gurkha booth.

Editor’s Comments

When Gurkha announced its collaboration with Mike Tyson, there was a lot of excitement about Tyson entering the cigar business. Unfortunately, similar to Tyson’s disappointing comeback against Jake Paul, the Tyson 2.0 Undisputed by Gurkha also falls short of expectations.

Of course, Espinosa Cigars and Guy Fieri were compared. Much has been made about Fieri’s involvement in the cigar industry; he has been more involved than any other mainstream celebrity. Expecting Tyson to have the same level of involvement was unrealistic and unfair.

Tyson attended the 2024 PCA Trade Show to greet retailers at the Gurkha booth, but he did not engage further afterward. It became clear that this was more of a licensing deal for the Tyson name on the Tyson 2.0 Undisputed line. This isn’t a knock; it is just what it is.

The project lost momentum after the PCA Trade Show show. The cigars didn’t create much buzz, arriving at retailers later in the spring. When the Tyson-Paul fight came around in November, I expected retailers and Gurkha to promote the Tyson cigars at watch parties. That did not happen. Independent of the quality of the cigars, this project just fell short of expectations.

Personnel Changes/In Memoriam

As usual, we have our carousel of industry moves. Please note this is not meant to be an all-inclusive list of every employment change for every employee. The decision as to what moves to include is subjective to reporting guidelines.

- Adam Altman: Named Chief Operating Officer and General Counsel at Crux Cigars

- Dylan Austin: The longtime Davidoff/Camacho executive and, most recently, President of Davidoff Geneva USA has departed the company.

- Benoit Bail-Danel: Named Hiram & Solomon’s Brand Manager for Europe

- Kevin Baxter: Joined Tabacalera Familia Disla S.A.

- Regis Broersma: Promoted to Chief Commercial Officer at Scandinavian Tobacco Group

- Ricardo Carioni: Named Head of Business Development at Casa Turrent

- Jonathan Carney: Departed La Flor Dominicana and named CEO at Bentley Tobacco | USA

- Ciro Cascella: The Executive President of Tabacalera A. Fuente has been named Vice President of Procigar

- Mike Copperman: Named Mike Copperman Named Executive Director at Cigar Rights of America

- Raul Disla: Departed Nicaraguan American Cigars S.A. (NACSA) and joined Tabacalera Familia Disla

- Lana Fraser: Named interim Vice President of Davidoff of Geneva, USA

- Dan Gallagher: Named President of Smoker Friendly

- Alex Goldman: Departed Quality Importers to become Chief Operating Officer at Cigar Page

- Litto Gomez: The owner and founder of La Flor Dominicana has been named President of Procigar

- Litto Gomez Jr: Named Vice President of Retail Partnerships and Sales at La Flor Dominicana

- “Big” Tony Gomez: Named National Sales Manager at Jake Wyatt Cigar Company, departed later in the year to become Head of Business Development at Luciano Cigars.

- Eddy Guerra: Departed Davidoff as Head of Marketing and Senior Brand Manager

- Joshua Habursky: Named full-time Executive Director

- Selim Hanono: Returned to E.P. Carrillo as Chief Operating Officer

- Luc Hyvernat: The Senior Vice President & Chief Commercial Officer at Oettinger Davidoff AG has departed the company

- Ike Karapides: Named Senior Vice President of Sales at Drew Estate

- David Lazarus: Retired from Drew Estate, where he was Vice President of Sales

- Shannon Marie: Named Shannon Marie Director of Trade Show & Events at PCA

- Zac Medwin: Named interim President of Davidoff of Geneva, USA.

- Christopher Mey: Departed Rocky Patel Premium Cigars and launched Christopher Mey Premium Cigars

- David Ozgo: Departed Cigar Association of America, where he served as President

- Mike Palmer: Named National Sales Manager for Pospiech Distribution

- Scott Pearce: Departed as Executive Director of the Premium Cigar Association and became President of the Cigar Association of America.

- Ferdinand Piet: Named Vice President of Business Development for APAC and MENA at LOFB Cigars

- Raquel and Patricia Quesada: Assumed ownership of Quesada Cigars

- Fred Rewey: Departed Illusione Cigars and became a partner in Cigar Press

- Trey Mac Shipley: Named National Sales Manager at JRE Tobacco Co

- David Spirt: Departed E.P. Carrillo where he served as COO and joined SZ Distribution.

- Wayne Stoner: Promoted to National Sales Manager at E.P. Carrillo

- Allison Trainer: The Vice President of Sales departed Hooten Young and is focusing on her consulting company

- Jennifer True: Named Vice President of Marketing and Operations at Fratello Cigars

The following people from our industry passed away in 2024:

- Rudy Padrón: Member of the Padrón family.

- Michael Peacock: Owner of Michael’s Tobacco

- José Seijas: Longtime factory manager and master blender at Tabacalera de Garcia.

- Joel Sherman: Longtime CEO at Nat Sherman International

- Ted Tetkowski: Longtime Tatuaje rep.

- Luis Tiant

Editor’s Comments

In 2024, there were many moves, promotions, and terminations in the cigar industry. However, the longstanding rule that “nobody gets fired in the cigar industry” still held true. Perhaps the most interesting moves have been to Tabacalera Familia Disla, which now boasts a “residency” of Esteban Disla, Raul Disla, and Kevin Baxter. I’m surprised more hasn’t been said about Raul’s departure from NACSA and joining forces with his brother. Nonetheless, I think the residency is something to keep an eye on in 2025.

The Cigar Coop Coalition wishes to express our condolences to the families, friends, and loved ones of those who passed away.

Photo Credits: Cigar Coop, except where noted.