For the 12th consecutive year, we bring you our selections and analysis for the Top 12 cigar industry news stories and themes for the year. Unlike how we consider cigars for our Cigar of the Year Countdown, these news story selections are based on the actual calendar year for 2022.

These stories are individual stories or ones that are multi-faceted. Some even overlap. Most importantly, they are the ones that had the greatest impact on the cigar industry as a whole.

These twelve stories are not listed in any particular order of importance. Instead, they have been somewhat arranged logically to allow a better flow.

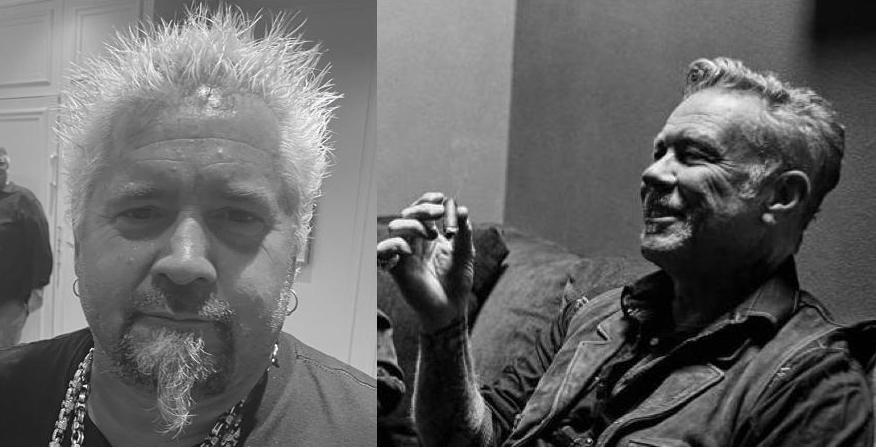

Mainstream Celebrities in the Cigar Industry: Guy Fieri/Metallica

Mainstream celebrities getting involved in cigar projects are nothing new. We have seen the likes of Armand Assante, Mike Ditka, Gary Sheffield, David Ortiz, and Jeremy Piven come out with their own branded cigars. 2022 saw mainstream celebrity involvement go to the next level with Guy Fieri and Metallica getting involved with high-profile cigar brands. These are perhaps two of the biggest names to get into the cigar business

Guy Fieri would team with Espinosa Cigars to launch a whole brand known as Knuckle Sandwich. Owner Erik Espinosa has said he originally was reluctant to do a celebrity-endorsed cigar for Fieri because many times these projects fail. But he encouraged Fieri to put in the work to build the brand and the collaboration was a success. Throughout the year Fieri could be seen making impromptu retail shop visits and even some events. Fieri appeared at events such as The Great Smoke, La Zona Palooza, and the 2022 PCA Trade Show. In addition to Fieri doing his part, Espinosa Cigars should be highly commended for the work they put in. This was quite evident at the PCA Trade Show where the company was extremely well-organized and did a great job at handling Fieri’s presence and some of the biggest crowds to be at a booth. They also sold a lot of cigars. The company reported large volumes of sales for Knuckle Sandwich releases.

Drew Estate launched a project done in collaboration with James Hetfield of Metallica, and Master Distiller Rob Dietrich known as Blackened M81. Blackened was the name of a whiskey that Hetfield and Dietrich developed together, and through Dietrich’s friendship with Jonathan Drew, they expanded into premium cigars. This is a regular production line by Drew Estate that came out late in 2022 and the launch was promoted by all of the parties involved.

[themify_box style=”light-green” ]

Editor’s Comments

I’m curious to see what happens with the Knuckle Sandwich and Blackened M81 projects. I don’t mean this in a cynical manner. My feeling is both Espinosa Cigars and Drew Estate will be giving their full support to publicizing both of these brands. Espinosa has said they have more projects with Fieri in store, and one was recently released – Knuckle Sandwich Connecticut. As for Drew Estate, the Blackened M81 project was only launched toward the end of 2022, so this project is just getting off the ground. While it remains to be seen if James Hetfield will be at cigar events, Drew Estate has one of the strongest marketing teams out there, so I would put my money on this being a success.

[/themify_box]

Industry Calls for “Responsible Marketing”

For the past few years, the premium cigar industry has seen its share of creative branding – with some of it being on the controversial side. On February 1, 2022, the Premium Cigars Association (PCA) issued a statement calling for “Responsible Marketing” of premium tobacco products. The statement emphasizes that “marketing that makes use of characters, foods, or candy associated with children’s interests are never appropriate, even when targeted toward an adult audience.”

The reason given for this is that for many years the premium cigar industry has worked to establish their products as marketed exclusively to adults. While the industry certainly has taken measures at the retail and distribution level to ensure that these products do not get marketed to children, the packaging and marketing of some of these products have sent a mixed message to lawmakers and regulators.

In March, the NASEM (National Academies of Sciences, Engineering and Medicine) released a report entitled Premium Cigars: Patterns of Use, Marketing, and Health Effects. The study contains 13 conclusions related to health risks, addiction potential, and second-hand smoke exposure associated with premium cigars. While there were some positives to the cigar industry in the study, some concerns were raised in the report when it came to marketing. The study noted how cigar lifestyle magazines, festivals, and social media sites have become popular forums for the tobacco industry to market premium cigars. It noted how many of these things were aimed at younger cigar enthusiasts. NASEM claims that, in these forums, the evidence is strongly suggestive that premium cigars are marketed as a product with benefits that outweigh their adverse health effects. NASEM recommended that federal agencies should conduct or fund research to determine the unique type of marketing, advertising, and promotional practices used by premium cigar companies to sell product. NASEM also recommended these agencies should identify strategies for tracking the activities, especially those that may appeal to youth.

In April, the PCA doubled down when Glynn Loope and Joshua Habursky of the Premium Cigar Association penned an article entitled “Let’s Not Candy Coat the Situation.” In the article, the authors took the position that such marketing initiatives should “cease immediately” and also called for “self-regulation.”

[themify_box style=”light-green” ]

Editor’s Comments

The concept of using marketing that makes use of characters, foods, or candy is not new. No matter how hard the cigar industry has tried to educate the FDA and members of Congress on this statement, it continually comes up and our industry cannot ignore the fact this perception is out there. Many in the industry have been careful to avoid that perception in their marketing, but some have not.

The PCA has done a good job of raising awareness of the issue. They have not taken any steps toward the enforcement of self-regulation as of yet. It will be interesting to see if some initial steps are taken in this direction, how fairly enforcement of self-regulation is done, and how it will be met by the cigar industry in the coming year.

From this author’s standpoint, the cigar industry is one of the most creative ones out there – and it is something that makes it quite unique. Many in the industry like to have fun, and that’s great, but it’s important not to get into trouble and make the whole industry look bad.

[/themify_box]

Distribution Divorces

Many times companies enter into distribution arrangements. These distribution agreements happen in various degrees. The term “distribution” involves some or all of the following: sales, warehousing, fulfillment, and marketing activities. It’s not unusual for a company to take on distribution for another company. It’s also not unusual for a company to turn over distribution activities to another company. In the end, these arrangements do not last forever and ultimately a company may switch or take over its own distribution. This year, two higher-profile distribution arrangements came to an end. In each of these two cases, the company that had previously had its distribution handled by another company ended up taking control of its own distribution.

First up in November, La Aurora announced it was taking over its own distribution. Previously La Aurora was distributed by Miami Cigar and Company, and this included sales, warehousing, and fulfillment. The Miami Cigar/La Aurora arrangement had been one of the longest ones in recent history in the cigar industry – lasting over 30 years. With the split, La Aurora has established a U.S.-based company called La Aurora USA LLC, and it has named Ed McKenna (formerly of Scandinavian Tobacco Group) as its CEO. La Aurora’s move didn’t come as a total surprise and over the past year, La Aurora cigars had started selling directly to consumers, and Miami Cigar had reduced its sales force late in 2020. Still, on the surface, this appears to have been an amicable split.

In addition, back in September, the split between Crowned Heads and ACE Prime took place. ACE Prime products were distributed by Crowned Heads as a part of a strategic partnership the two companies established in 2020. Under that partnership, Crowned Heads handled sales, warehousing, and fulfillment, and also provided Tabacalera Pichardo, a factory owned by ACE Prime, to produce several Crowned Heads products.

Crowned Heads/ACE Prime was a much more acrimonious split with plenty of bad blood from both sides of the fence. On one hand, Crowned Heads said they ended the distribution agreement with ACE Prime. On the other hand, ACE Prime said it terminated the agreement and made this move to take over its own distribution. At the time of the split, ACE Prime rebranded to Luciano Cigars. In addition, this has been complicated by Luciano Cigars also being in an acrimonious dispute over ownership of the Pichardo factory.

[themify_box style=”light-green” ]

Editor’s Comments

We can Monday Morning Quarterback what reasons led to these splits, but I’m not sure it does any good here. The four companies involved: Miami Cigar, La Aurora, Crowned Heads, and Luciano Cigars all have their reasons for making the decisions they made. These are business decisions, and certainly, they must be respected. It was sad to see these splits happen. La Aurora and Miami Cigar had been joined at the hip for a long time and ultimately this was like a long-time marriage coming to the end. While the Crowned Heads/ACE Prime arrangement had only been in place for two years, to the outsider, there seemed a lot of good that still came of it. Ultimately the bitterness involved in the Crowned Heads/ACE Prime split was quite disappointing to see. In the end, this author wishes all of the parties the best and looks forward to what the future brings to all of these companies.

[/themify_box]

Around 60 New Releases from STG

There was a lot of new product introduced into the market by Scandinavian Tobacco Group. It seemed like there was a press release coming out every week with something new. Judging by what we reported on (and there could be more), this author calculates that a total of 59 different products were introduced. These products were distributed mostly through STG’s General Cigar and Forged Cigar Company channels. There were several products also made available through Meier & Dutch.

Below is a list of what was introduced. This is an approximate list.

- Bolivar Cofradia Lost & Found EMS

- Bolivar Cofradia Lost & Found Oscuro

- Buffalo Trace Special F

- Bull Moose

- CAO Amazon Basin (2022 Run)

- CAO Arcana Firewalker

- CAO Borealis

- CAO BX3

- CAO Pilón Añejo

- CAO Vision

- Cohiba Serie M Corona Gorda

- 2022 Weller by Cohiba

- Diesel Atonement TAA Exclusive

- Diesel Disciple (Regular Production)

- Diesel Fool’s Errand Stubborn Fool

- Diesel Sunday Gravy Gabagool

- Diesel Sunday Gravy Grappa

- Diesel Sunday Gravy Porcellino

- Diesel Sunday Gravy Rosamarino

- El Rey Del Mundo by AJ

- El Rey del Mundo Naturals

- Evelio

- Fireball Cinnamon

- FLVR Fist Bump

- FLVR Ski Chalet

- FLVR Space Ranger

- FLVR Unicorn Tears

- FLVR Yacht Rock

- Illusione of Excalibur

- La Gloria Cubana Eighth Street

- La Gloria Cubana Serie R Natural No. 8

- La Gloria Cubana Serie S

- La Gloria Cubana Society Cigar

- Latitude Zero Signature

- Los Statos Deluxe

- Macanudo Estate Reserve Flint Knoll

- My by Macanudo Dark Rum

- M by Macanudo French Vanilla

- M by Macanudo Mint Cocoa

- Macanudo Gold Label 2022 Gran Pyramid

- Macanudo Inspirado Green Gigante

- Macanudo Inspirado Jamao

- Partagas Añejo

- Partagas Classic Toro Tubo

- Punch Fu Manchu

- Punch Rare Corojo Aristocrat

- Punch Knuckle Buster Maduro

- Punch “The People’s Champ”

- Room101 13th Anniversary

- Room101 Farce Nicaragua

- Room101 -The Big Payback Nicaragua

- Sancho Panza Double Maduro

- Sancho Panza Extra Fuerte

- Sancho Panza Original

- STG Holiday Samplers: CAO 12 Days

- STG Holiday Samplers: Diesel Sideshow

- STG Holiday Samplers: El Rey Del Mundo

- STG Holiday Samplers: Punch

- Warzone Rabito

[themify_box style=”light-green” ]

Editor’s Comments

If you were one of the people wondering why STG spun Forged Cigar Company off from General, it was answered this year with STG introducing nearly 60 products to market. While I still have trouble delineating General from Forged, I can see splitting the STG portfolio into two sales teams making it easier to sell these products. Still, this was a lot of new product being introduced in each channel.

Looking at this list I saw a lot of limited and small batch releases – which I think not only competed among those releases but didn’t help the core offerings. Whether limited or core, there wasn’t a release on this list that I felt became the next great cigar line.

Regardless, I cannot see STG doing this again in 2023, and I think they need to get recommitted back to focusing on the core regular production lines.

[/themify_box]

El Septimo Geneva

El Septimo Geneva is certainly a company that made headlines in 2022.

El Septimo is not a new company. Based in Switzerland, the company was founded in 2005 and has focused on the ultra-premium sector of the premium cigar industry. In 2019, Zaya Younan, owner of the private equity firm the Younan Company, bought the company after falling in love with the brand. With 3.2 billion dollars in assets behind him, it’s clear that Younan is determined to grow El Septimo into a power player in the premium cigar industry.

On the scale of his holdings, Younan has said El Septimo is one of the smallest companies he has, but he says it’s the one he is spending the most time with. The company certainly made a buzz at the 2022 PCA Trade Show with its set of $5.5M lighters. The company continues to grow its ultra-premium portfolio with an emphasis on art and history. This year the company launched its Emperor Collection, bringing the portfolio to 42 different blends (the company says each vitola has a unique blend). It also announced an ambitious plan to open 30 lounges over the next three years by rebranding existing lounges or opening them in retail stores. The company has announced lounges in Los Angeles and Hollywood. In addition, El Septimo has also been promoting itself as a lifestyle brand going into the spirits and wine space.

[themify_box style=”light-green” ]

Editor’s Comments

Many may scratch their head and question why I would put El Septimo on the Top 12 Stories and Themes for 2022. The answer is easy – people are talking about the company. On the surface, it seems Younan has been putting on a clinic for how to promote and market his brand. At the same time, I still think there is a lot of work to do before I’m ready to put El Septimo along the sides of luxury brands such as Davidoff, Arturo Fuente, and Selected Tobacco. Quite frankly, I still think the story from a tobacco and cigar-making standpoint is kind of weak when compared to the three luxury companies I just mentioned. Flashy packaging and shock-marketing (like 5.5M lighters) are one thing, but the cigar industry has proven you need to have the story of your brand nailed down. While El Septimo claims to be the fastest-growing cigar company, the company still does not have a full in-house sales force – and that’s something else that will be needed if the company wants to reach the next level.

El Septimo got noticed this year. Even in the industry, many didn’t know about Zaya Younan and his brand on January 1st, 2022. As we are on December 31, 2022, it’s safe to say if you follow the industry and premium cigars, you now know about Younan and his El Septimo brand.

[/themify_box]

La Flor Dominicana’s NFT Offering

Earlier this year, La Flor Dominicana announced a Lonsdale size of its popular Andalusian Bull. It was originally dubbed the Golden Bull, and later was renamed the Golden NFT due to a potential trademark issue. The only way to get the right to purchase the Golden NFT was to acquire an NFT. La Flor Dominicana put out seven NFTs for auction, and anyone (retailer, consumer, distributor, etc) could bid on the NFT. The seven people who acquired the NFT received a special Gold Bullion Humidor containing 50 Golden NFT cigars. They also have the right to buy up to 70 Golden NFT Cigars per month, which are packaged in 14-count boxes.

If you aren’t familiar with NFTs, it is a unit of data on a digital ledger known as a blockchain where each NFT represents a unique digital item that is typically bought for investments. In this case, acquiring the Golden Bull NFT will give you the right to purchase the Golden NFT Cigar.

The auction was held throughout the month of August, and the bidding stirred up quite a lot of interest. Each NFT sold in a range between $78,0001.00 and $98,001.00 for a total of $614,779.00 or an average of $87,825.57. Five of the seven NFTs have been confirmed to go to retailers.

The following were the results:

- NFT 1: $85,000.00

- NFT 2: $78,001.00

- NFT 3: $90,000.00

- NFT 4: $90,000.00

- NFT 5: $92,000.00

- NFT 6: $81,777.00

- NFT 7: $98,001.00

[themify_box style=”light-green” ]

Editor’s Comments

On the plus side, hats off to La Flor Dominicana for the planning and execution of the NFT auction and Golden NFT cigar. The auctions certainly created a lot of excitement. It even prompted Smoke Inn and Pete Johnson to plan their own NFT Program in 2023.

On the negative side, I don’t think the retailers who acquired these NFTs have quite figured out what to do with the cigars. I saw this cigar first listed for $200.00, and then discounted to $100.00 to $150.00. With all due respect to everyone involved, I can’t see demand for this cigar at those price points. The limited edition market is already saturated and a Lonsdale size is not popular. When you are pricing individual cigars over $30.00, you are starting to deal with a whole different market (i.e. the ultra-luxury market), so unless targeted marketing by the retailers is targeted and viewed by that segment, I don’t think these will be fast sellers. Ultimately the retailers may be more concerned about the value of the NFTs, so the cigars may be a secondary issue.

[/themify_box]

The CAO Alumni

For the past 25 years, there have been two major faces of the CAO Brand – the first was Tim Ozgener when his family owned the company. When Ozgener stepped away from the business in 2010, Rick Rodriguez would become the face of the brand and remained there until the end of April 2022. This year, both Ozgener and Rodriguez found new homes within the cigar industry.

Tim Ozgener’s return certainly was one of the big stories of 2022. Ozgener has come back to the industry in a big way – launching his own company Ozgener Family Cigars, and then as a partner with Crowned Heads (co-owners Mike Condor and Jon Huber worked for him at CAO). Ozgener made his official return to the industry at the 2022 Premium Cigar Association Trade Show.

Meanwhile, after nearly 12 years as the face of CAO, it was announced that Rick Rodriguez was retiring. Rodriguez’s retirement would take place at the end of April. Ten days later, Rodriguez was back and announced that he and former General Cigar alumnus Gus Martinez would be partnering in a new venture called West Tampa Tobacco Company. They also announced the launch of two lines: Black and White – followed by the limited edition Attic Series. West Tampa had a soft launch before the 2022 Premium Cigar Association Trade Show, but essentially also made its debut at the Trade Show.

[themify_box style=”light-green” ]

Editor’s Comments

CAO alumni were certainly out strong at this year’s trade show and beyond. Ozgener and Rodriguez would join an alumni class that includes Mike Condor, Jon Huber, and Miguel Schoedel of Crowned Heads as well as Micky Pegg of All Saints Cigars. There was no doubt that both Ozgener and Rodriguez’s moves this year were two of the “feel good” stories in the cigar industry in 2022.

With Ozgener returning, it was a chance for many old friends and cigar enthusiasts to reconnect with him. Given Ozgener was gone nearly 12 years, there are many new cigar industry people and new cigar enthusiasts who will now have a chance to know him. This author was in the latter category, and I found Ozgener to be a genuine and dynamic personality who I expect will do a lot of good for the cigar industry.

Meanwhile, Rodriguez left the corporate world of General Cigar and launched a boutique company (West Tampa Tobacco Co.). Rodriguez was always one of the more popular personalities at General, but now that he is at the helm of West Tampa, it almost seems like his popularity has grown.

In the end, Ozgener and Rodriguez will be judged on the success of the cigars they produce, but there is no denying both are off to a flying start.

[/themify_box]

Cigar Industry Scores Big in Court Against the FDA

This past July, the premium cigar industry (represented by the Cigar Association of America, Cigar Rights of America, and the Premium Cigar Association) got a major win in the Courts. Judge Amit P. Mehta of the U.S. District Court of Columbia ruled that the U.S. Food and Drug Administration’s decision to not exempt premium cigars from regulation on the Final Deeming Rule was arbitrary and capricious. His decision didn’t nullify the Deeming Rule, but it most likely will send the FDA back to the drawing board. Since the ruling, both the cigar industry and FDA have submitted briefings for Mehta to decide on a ruling.

In his ruling, Judge Mehta stated: “there were no data provided to support the premise that there are different patterns of use of premium cigars and that these patterns result in lower health risks.” 81 Fed. Reg. at 29,020 (emphasis added). In other words, the agency did not evaluate the data on premium cigar usage patterns and “reasonably explain” why those patterns did not reduce public health risks.”

His ruling also called out misleading data by the FDA in a study done by Christine Delnevo. The study found 3.8% of 12 to 17 years olds claimed to smoke a cigar over a 30-day period, but 3.3% of them smoked a premium cigar. When looking at 3.3% of a 3.8% percent of a population of 12 to 17-year-olds estimated a 25,000,000 – it comes out to 0.1% or 31,350. The judge said this essentially flies in the face FDA’s exertion that: “Although youth and young adults tend to smoke mass market cigar brands, they are also using premium cigars” and ruled the FDA acted arbitrarily and capriciously.

[themify_box style=”light-green” ]

Editor’s Comments

Charlie Minato of Halfwheel did an excellent job of assessing Judge Mehta’s ruling. According to Minato, the best-case scenario is the FDA abandons the Deeming Rule. The worst case scenario will be an Appeals Court overrules Mehta’s decision. I agree with Minato that the best-case scenario will not happen. Minato also mentions the fact that the FDA has higher priorities – namely going after flavored cigars, alternative products, and menthol cigarettes. That could definitely work in favor of the cigar industry on holding off any future iterations of a Deeming Rule. I’m still concerned the FDA may crack down harder on media and advertising rules – and this is something I would like to see PCA, CAA, and CRA (and other industry personnel) take a stronger stance on fighting as it affects almost all of us associated with the cigar industry. For now, Mehta’s ruling is something the industry really needed, but the long-term battle may be far from over.

[/themify_box]

FDA Takes Major Step to Ban Flavored Tobacco

On April 28, 2022, the U.S. Food and Drug Administration (FDA) took a major step toward banning flavored cigars and menthol cigarettes. The agency published its proposed rulemaking that would implement a ban on flavored cigars and menthol cigarettes.

The FDA’s rationale for the bans revolves around youth access to tobacco. While both bans were announced together under a common theme of reducing tobacco access to youth, the two bans have separate rulemaking. The moves being made are aimed at implementing the Biden Administration’s Cancer Moonshot program which will attempt to reduce the death rate of cancer by at least 50 percent over the next 25 years. The FDA has said tobacco is a leading cause of cancer and has claimed that 30 percent of all cancer deaths in the United States are caused by smoking.

As a part of the rule-making process, a public comment period was opened up from May 4 through August 4th, 2022. In addition, the FDA held two public listening sessions on June 13 and June 15. The PCA was denied the opportunity to speak at those listening sessions. This feedback is used to develop the final rule. Once the final rule is published, the implementation of the bans is scheduled to take place a year later.

[themify_box style=”light-green” ]

Editor’s Comments

There are more steps that need to happen before a final rule is implemented. There are two things worth considering:

- The FDA has rarely embraced public comments challenging its rules. It has not done this in past, and I don’t expect it will do it again.

- Nothing moves fast with the FDA. Expect more delays with implementation and a potential court challenge.

Net/Net – Storm clouds are closing in, so expect a formidable battle. Most likely this will be heading to the courts as well.

All that did not stop the release of many flavored cigar products. This included Scandinavian Tobacco Group’s FLVR line and extensions to M by Macanudo.

[/themify_box]

Cuba

This is simply a catch-all theme for everything that was happening in Cuba this year. Whatever your thoughts are on the Cuban market, one cannot deny the country 90 miles from Key West made some headlines this year.

First up, many have continued to notice Habanos SA not keeping up with demand for its product. This has resulted in limited availability of many products, and in some cases, there have been some empty shelf spaces at retailers in the international (non-U.S.) market that normally carry Habanos SA product.

The future may see more difficulty in terms of demand as a result of tobacco lost due to Hurricane Ian. Hurricane Ian, which was one of the strongest storms of the Atlantic Tropical Storm season, made a direct impact on Western Cuba, specifically the Pinar del Río region. Prominent grower Hirochi Robaina posted pictures from his farm indicating major damage to his operation.

It had already been a tough year in Cuba as the country has seen shortages of fuel and food, and numerous electrical blackouts throughout the country.

Meanwhile, price increases are definitely being seen in the Habanos SA portfolio, none of which got more attention than the Cohiba 55 Aniversario Edición Limitada which is being sold at $300.00 per cigar. The price change comes as a result of demand and Habanos SA’s desire to position Cohiba as a luxury brand. The other brand to see significant increases in price is Trinidad. Habanos SA made the decision to set the pricing of its products to be in line with pricing in Hong Kong.

The Cohiba 55 Aniversario would have normally gotten a launch at Festival del Habano, but the 2022 edition was cancelled because of ongoing concerns and effects of the COVID-19 global pandemic. There was a smaller-scale festival held in September that would give the Cohiba 55 Aniversario a gala-like launch. A record-setting $2.8M bid on a Cohiba humidor was placed at the gala. Meanwhile, Habanos SA has also announced Festival del Habano is returning in 2023.

Toward the end of 2022, Cubatabaco (parent company of Habanos SA) scored a victory over Scandinavian Tobacco Group (STG) when the U.S. TTAB ruled to cancel STG’s Cohiba Trademark. While the non-Cuban versions of the Cohiba product aren’t going anywhere soon, it still is something newsworthy here.

[themify_box style=”light-green” ]

Editor’s Comments

I don’t think I’ve seen a year like 2022 for the Cuban cigar industry like this. I’m not sure 2023 or 2024 will get much easier. While Habanos SA was able to put on the Cohiba Aniversario gala in September, I’m more curious to see what they do for Festival del Habano and how logistics work for attendees.

As for pricing, I’m not sure I have a good crystal ball on how to read this. A lot will depend on if Habanos can catch up with demand, and if the global economy keeps up with the demand. The Cohiba pricing move is a separate issue in a lot of ways. This is Habanos SA’s move to position Cohiba as its “Rolls Royce” or “Rolex” product – and it’s a very different segment of the market than most cigar enthusiasts are used to.

[/themify_box]

Higher Prices

Every year we have seen price increases from cigar companies due to the cost of doing business. 2022 has not only seen a slew of price increases on existing products, but also a lot of first-time companies entering the market with some very high price points.

Some examples (this is not meant by any means to be a complete list) include:

- Habanos SA, especially Cohiba: See Cuba section above

- Davidoff: Davidoff Year of the Rabbit 2023 ($50.00), a limited edition cigar that is an $8.00 price increase from the previous installment, Davidoff Year of the Tiger 2022 ($42.00). Davidoff’s Oro Blanco is now priced at $600.00, and that’s a 20% increase. There are also reports of significant increases being made to the Royal Release ($10.00 increase) and Davidoff Winston Churchill Late Hour.

- E.P. Carrillo: The company is releasing the Aura E.P. Carrillo Shengxiao Limited Edition, a 12-cigar sampler for the Chinese New Year priced at $1000.00 USD/12-count box or $83.33 per cigar

- Freud Cigar Company This new company has launched with it Agape Limited Edition ($30.00 USD per cigar) and Superego ($17.00 – $19.00 USD per cigar)

- Casa 1910: A company out of Mexico that launched in 2021. This year they introduced four lines – each priced from $16.50 – $18.00 USD

- Oliva: Launched the Cuba Aliados by Ernesto Perez-Carrillo priced between $14.00-$15.50 USD per cigar

- Foundation Cigar Company: The latest installment of its Highclere Castle line, the Highclere Castle Senetjer is priced at $33.00

- La Palina: The La Palina Goldie Languito No. 2 returned for the first time in a decade. In 2012, the cigar was priced at $15.00 USD per cigar. This year, it’s priced at $23.00 USD per cigar.

- Plasencia: The Plasencia Ehtëfal, a limited edition cigar has been priced at $65.00

- Pure Aroma Cigars: The D’Crossier Golden Blend Refinados is being launched at a price point of $23.00 – $25.00 USD per cigar

[themify_box style=”light-green” ]

Editor’s Comments

It’s easy to blame inflation for these higher price points and higher prices increases, but is it the sole reason?

I’m not sure anyone will admit it, but I’m convinced the higher price points coming from luxury brands like Davidoff and Arturo Fuente are because of the fact that these brands see themselves in the same, if not a higher quality class than Cohiba.

Ironically, some companies like Drew Estate doubled down and invested in an extension to the Nica Rustica line, the Adobe priced $5.20 USD – $6.50 USD per cigar.

Unfortunately, media is usually the last to know about price increases, but that’s a gripe session for another time…

[/themify_box]

Personnel Changes/In Memoriam

As usual, we have our carousel of industry moves:

- Steve Abbot: Named Director of Marketing at Scandinavian Tobacco Group

- Dr. Robert Califf: Named U.S. Food and Drug Administration Commissioner

- Alec Cuevas: Promoted to Director of Brand Development at Casa Cuevas Cigars

- Brian Diggins: Named National Sales Director at Karen Berger/Don Kiki Cigars

- Stijn Elberson: Named Global Sales and Marketing Director at West Tampa Tobacco Co.

- John Ferrigan: Named National Sales Director of La Aurora USA LLC

- Liana Fuente: Departed Arturo Fuente Cigar Company

- Michael Giannini: Joined Quality Importers Trading Company as Chief of Consumer Engagement

- Alex Goldman: Promoted to Chief Operating Officer at Quality Importers Trading Company

- Joseph Gro: Departed Drew Estate and joined Quality Importers Trading Company as Director of Marketing and Communications

- Joshua Habursky: Named Deputy Executive Director at the Premium Cigar Association

- Michael Herklots: Named to Premium Cigar Association Board of Directors

- Dr. Brian King: Named Director for the Center for Tobacco Products (CTP) at the U.S. Food and Drug Administration (FDA)

- Mudi Kpohraror: Named State Government Relations Director at the Cigar Association of America.

- Jared Michaeli Ingrisano: Promoted to President of Mombacho Cigars S.A. (February 2022), but would depart the company before year’s end to launch Favilli Trading LLC.

- Ed McKenna: Named CEO of La Aurora USA LLC

- Brian Motola: Departed Illusione Cigars and was named Director of Sales and part owner of Cavalier Genève

- Ryan Parada: Promoted to Senior Manager of Government Affairs and International Policy at the Premium Cigar Association

- Kevin Petosa: Named Director of Business Development and Credit at El Septimo Geneva. He had previously been with J.C. Newman Cigar Company as a Credit Manager.

- Ryan Ponist: Named Business Development Manager at Alec Bradley Cigar Company

- Hamlet Paredes: Departed Rocky Patel Premium Cigars and joined the team at Bond Roberts

- Fred Rewey: Named Brand Strategist at Illusione Cigars

- Irving Rodriguez: Named Global Sales Manager at PDR Cigars

- Rick Rodriguez: “Retired” from Scandinavian Tobacco Group (STG) and launched West Tampa Tobacco Co.

- James Shaffer: Named National Sales Director at 7-20-4 Cigars

- Ed Trevino: Named Director of Sales at Luciano Cigars

- Jarrid Trudeau: Named to Premium Cigar Association Board of Directors

The following people from our industry passed away in 2022:

- Kris Kachaturian

- James Shaffer

- Carlos Toraño

- Rolando Villamil

[themify_box style=”light-green” ]

Editor’s Comments

Lots of moves in the industry, but once again based on what actually gets announced (or not announced) the theme of “nobody gets fired in the cigar industry” is alive and well. While 2022 had its share of industry moves, it seemed less than in previous years.

Our condolences to the families, friends, and loved ones of those who passed away.

[/themify_box]

January 5, 2023 @ 10:11 pm

Great work, Coop! This wrote up is the result of tremendous thought and effort.

“It’s easy to blame inflation for these higher price points and higher prices increases, but is it the sole reason?

I’m not sure anyone will admit it, but I’m convinced the higher price points coming from luxury brands like Davidoff and Arturo Fuente are because of the fact that these brands see themselves in the same, if not a higher quality class than Cohiba.”

From your lips (finger tops) to God’s ears.